The Conservative Case for the Progressive Income Tax

I support a low, simple, progressive income tax.

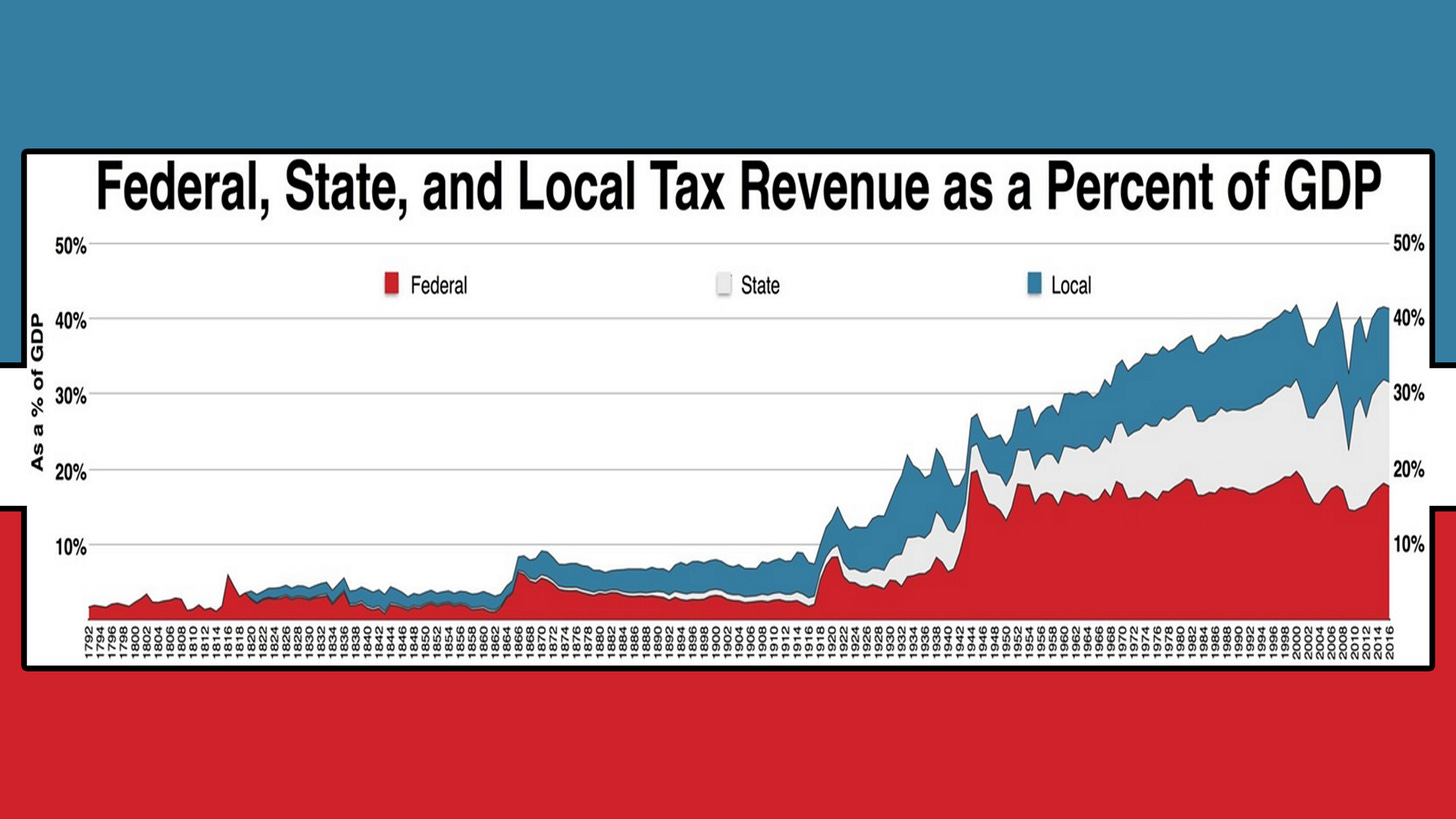

By low I mean I support reducing overall federal tax revenue.

By simple I mean I support abolishing the payroll tax, abolishing the personal income tax for the bottom 80% of the population, and taxing labor, investment, and inheritance at the same rate with no deductions, exemptions, or credits.

By progressive I mean I support proportionally graduating the income tax rate from the top 20% of the population to the top 1%.

The tax rate should be high enough to be able to fund Social Security and Medicare ($1.7 trillion in 2019), but not much higher than the status quo because the top 20% of the population already pay 80% of income taxes ($1.5 trillion in 2019) so by simply taxing investment and inheritance at the same rate as labor this would generate more than enough revenue to exceed the gap.

Following these principles, let’s say this roughly translates into graduating the tax rate from 1% to 20%.

This may not sound like much, but by broadening the base to gross income it’d be more comparable to other single-digit gross taxes like sales (6.35% avg.), import (1.52%), property (1.1%), and my corporate income tax reform (3%).

Some think we should just abolish the IRS and replace the federal income tax with a federal sales tax.

But stacking this federal sales tax on top of existing state sales taxes would lead to a lot more buying overseas and in black markets. And with such a concentrated tax burden every political interest group would seek to carve out a special exemption. In order to untax the poor, some have suggested giving them an EBT card that deducts the sales tax from “necessities” and/or giving everyone a monthly check for a few hundred dollars (FairTax prebate), but this could just lead to a federal agency that is more powerful than the IRS as it could micromanage down to a more frequent financial activity as people tend to earn biweekly and spend daily. The political pressure to raise the UBI every election cycle would also be enormous. Plus, so long as the 16th amendment exists then we are only one war away from the income tax being reimplemented.

I also wouldn’t do a flat tax. In my opinion, the best argument for a flat tax is its simplicity, but flat tax supporters don’t even support a true flat tax (aka a head tax) because they support a variety of exceptions, deductions, and credits. From my estimation, Steve Forbes comes the closest, but he still taxes on the “net” (i.e. excludes certain “expenses”) and offers a “generous standard deduction.” Rand Paul and Ted Cruz offer that for their flat tax proposals plus deductions for dependents, mortgage interest, charitable contributions, earned income tax credits, pensions, etc.

These qualifications undercut flat tax supporters’ moral argument about “fairness” because if flatness was inherently more fair then why abandon the principle and if the argument is about simplicity then my progressive tax is much more simple.

A little stroll down history lane also reveals the futility of such a “flat” tax because Abraham Lincoln implemented the first one in the United States in 1861, but the very next year he made it progressive. This same cycle has repeated itself in America and throughout the world. In researching for this essay I watched numerous flat tax talks and virtually all of them mentioned how Russia has a flat tax, but then just last year they abandoned it.

There are ultimately five main reasons I support a progressive income tax…

The more you make the easier it is to make. There are a multitude of factors for this such as your skills tend to be comparatively better, humans are emotional beings who feel more inspired to work harder at things others value, it’s cheaper to buy in bulk, it’s easier to get bigger loans with low-interest, which is especially useful in an inflationary currency, and people generally like you more. It’s amazing how handsome you become when you’re rich. A progressive income tax helps offset these natural and artificial competitive advantages so that those at the bottom can be a bit more of a competitive threat so that not only will those at the bottom work harder and smarter, but so will those at the top. It’s a win-win-win for the bottom-top-overall.

A progressive income tax offsets our numerous other proportional taxes, which fall more heavily on low incomes. Since the progressive income tax is just about the only progressive tax on our books then without it our tax system would become regressive therefore adding to the rich’s aforementioned competitive advantages.

Our emotional ape brains underlie our rationalizing neocortex where studies show you’re happier if you have a 20-inch TV and I have a 16-inch TV than if you had a 30-inch TV and I had a 50-inch one. In real terms, you’d be better off, but in relative terms, you’d be worse off. Some conservatives say the latter shouldn’t matter but are much more forthcoming in acknowledging it does when their wife ruminates about her ex Chad. Envy is natural and can even be motivating, but too much of it becomes self-destructive whereby those at the bottom will seek to pull down those at the top even if we know we’re hurting ourselves in the process. Education can offset this instinct, but not completely nor should it. I don’t want to indoctrinate away our natural egalitarianism, in part, because egalitarianism is particularly important in a democracy, which conservatives more readily admit when it’s put in terms of defending the middle class.

“The most perfect political community is one in which the middle class is in control, and outnumbers both of the other classes.” — Aristotle

With that said, roughly 80% of American millionaires are self-made so we should be skeptical of elites trying to whip us up into a self-destructive victimhood mentality in order to politically profit off it. America already has the most progressive tax code in the world too so my desire for progressivity isn’t a dystopian wish, but a conservative desire to preserve what works. As lowercase republicans, we understand the importance of deconcentrating political power and so this tax is simply applying this same principle to economic power.

In addition, a low, simple, progressive income tax would not only have the benefit of reducing inequality, but also increasing economic growth because there is a diminishing marginal utility of money where the more one makes the less happiness one derives from each next dollar. A progressive income tax takes fewer dollars from those who derive the greatest happiness from them. Studies show that happy people tend to work harder and cost society less money. The people at the bottom also spend their money more quickly, which higher monetary velocity is associated with a more robust economy. If our society did a better job at education then that money would be spent more on health, productivity, and knowledge. The wealth of a nation is closely tied to its collective knowledge. And with my progressive income tax the poor would be more incentivized to work since they wouldn’t face a 15% payroll tax and by taxing fewer individuals it’d leave less revenue and work for the administrative state.

Finally, this progressive income tax would not only be fantastic upon its implementation, but also in its ability to maintain its form. Stability!

Some will want to increase the rates and/or complexity beyond my proposal, but they’d face greater opposition from billionaires who are currently largely exempt from income taxes, therefore, they lobby to increase them in order to weaken their competition whereas under my progressive income tax they’d face the greatest brunt of it thus incentivizing them to lobby to keep it from rising. The average citizen would be more indifferent to the income tax just as we currently are to the estate tax so long as the government spending we like isn’t cut too much whereas the rich who’d be paying this tax would be more incentivized to make sure that government spending isn’t too inefficient or else the average citizen may come looking for them to foot the bigger bill. It took two world wars for our income tax to devolve into the monstrosity it is today and so if we could just avoid a third then I think given how much more simple my tax is to even the original 1913 one it’d be hard for politicians to raise the gross top rate beyond 30% because I believe this would reduce growth and revenue, which with greater clarity in outcome and a population with greater clarity of mind would help constrain such self-sabotage.

In the end, taxes are a necessary evil and so if we’re going to tax then we might as well do so in a way that reflects our values by embracing a low, simple, progressive income tax.