The Conservative Case for the Corporate Tax

There’s a lot of confusion around what a corporation is so let’s reason down to first principles:

If you want to start a business you fundamentally have two options: unlimited liability (UL) and limited liability (LL).

81% of American businesses choose unlimited liability: 73% sole proprietorships (one owner), 8% general partnerships (multiple owners).

19% of American businesses choose limited liability: 13.1% S corporations (no corporate tax, max 100 shareholders), 5.6% C corporations (unlimited shareholders).

Some on the Left view limited liabilities as sociopathic persons.

Some on the Right view limited liabilities the same as unlimited liabilities.

Both are wrong.

Corporations shouldn’t be taxed as if they’re a person nor should they not be taxed at all on the entity level.

Unlimited liabilities are like runners — the vehicle and the body are one — whereas corporations are like cars — the vehicle and the body are separate — and so if unlimited liabilities cause an accident the runner is liable whereas with corporations the car is liable. The latter sounds a little less absurd when you consider it tends to have a trunk full of cash, but nonetheless, this special layer of legal separation has societal benefits and costs.

What rate should the corporate income tax be?

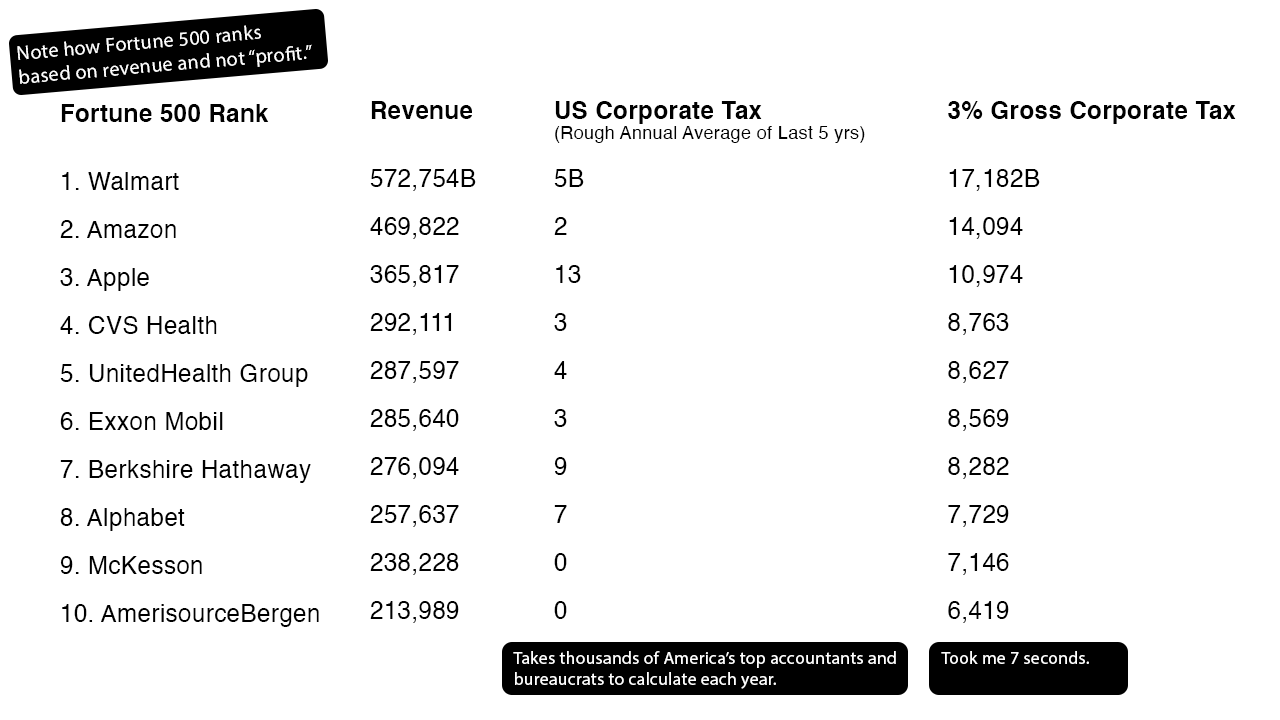

I believe we should stop taxing corporations on their “profits” because it’s so subjective that no two accountants can reach the same number. This subjectivity necessitates abuse and corruption.

Plus, only an idiot would want to be paid in “profits.”

If I loan, rent, or sell you something then I’d expect to be paid our agreed to price, which we could negotiate whether you pay it all upfront or in installments, but if it’s in installments I wouldn’t have its size determined by what you tell me is your income after “expenses,” which can include but is not limited to: shelter, food, transportation, labor, investments, etc. so you can shrug and say, “Oh, Anthony yeah I made $1 billion dollars, but after expenses I really have no profit leftover. Shucks!”

Some define dividends as coming from “profits.” They’re wrong. The money can come from revenue, reserves, debt, Grandma. Corporations give dividends — often quarterly — in order to attract investment and so even during profit losses remain “extremely reluctant to cut dividends since it can drive the stock price down.”

And so now that you’re one of the few people who actually understand what a corporation is then you understand it’s basically a liability insurance public option.

Liability insurance comes out to between 1% — 3% of gross revenue. I think the government should charge for its public option at the higher end via a corporate tax rate of 3% gross revenue.

Why not less than 3%?

As a conservative, I believe we should generally pay for our costs.

Corporations are much more regulated than UL’s so who should have to pay these bureaucrats’ salaries? The general taxpayer? No, the corporation should pay for them, which if they paid more directly for their regulation then perhaps they wouldn’t lobby as much for its increase, but even if we deregulated down to the bare essentials, corporations would still require more regulation than UL’s for the simple fact they exist purely through paperwork.

And without any corporate tax, we’d see a rise of shell companies as the wealthy try to avoid personal income taxes, but with this 3% tax, it’d reduce this incentive and therefore reduce the cost of enforcement.

A big part of why corporations have proliferated over the last century is because they pay a lower initial and overall tax than ULs. The lower initial tax means they can keep more of their money to reinvest back into the corporation and the lower overall tax is because the corporate tax (entity level) combined with the capital gains tax (individual level) is still generally lower than the personal income tax. This 3% tax would reduce corporations’ competitive advantage.

And since corporate owners (shareholders) are legally protected then if a court finds a corporation liable for damages who should have to pay to make the victims “whole again”? Corporate funds may be enough to do so, but if not then the cost is eaten by the victims and society. This 3% tax helps compensate society for this abdication of personal responsibility.

Finally, there’s a libertarian argument for abolishing corporations altogether, but I think rather than mandate it, this tax would disincentivize their creation because in the end… why do we even need a liability insurance public option?

Imagine a future where instead of a heavily regulated New York Stock Exchange we had an online Amazon equivalent — Amazon Stock Exchange — where in addition to buying steaks, people could buy stocks. Just as you may read the description, reviews, and warranties for an apple you may want to read it before buying Apple.

In order for them to get you to buy their stock, they’re incentivized to be extremely transparent. The exchange itself would inevitably set minimum requirements for companies to be able to list on it. And here’s the kicker: the exchange would probably offer liability protection so that when you as a potential buyer go to a company’s page you’d see one of two designations: unlimited liability (insured via the exchange at a 1% fee) or limited liability (insured via the government at this 3% tax + they may be insured via the exchange too at a discounted 0.5% fee). The former’s benefit is a higher return whereas the latter is less risk. I think naturally the market would gravitate toward the former as the courts would be pressured to rule more rationally again so that in the event of a lawsuit company funds and liability insurance(s) should be more than enough to cover damages without having to directly pass its cost onto the owners.

Why not make progressive?

Unlike individuals, corporations can break themselves down into smaller units. Large conglomerates control multiple corporations so to avoid taxes they could, for example, just make each department its own corporation and shift their revenue around so each unit stays in the lowest bracket.

Why not more than 3%?

3% is a safe bet since most small corporations would pay less while most large corporations would pay more. Anything more than 5% I think would be unsustainable and since what I’m proposing here is such a radical simplification from the status quo it only makes sense that we should proceed more cautiously with adjusting its effect on federal revenue.

In a democracy, it’s also particularly important that taxation be as direct as possible so voters can get a clear picture of how much they’re being forced to pay instead of trying to hide taxation at the top so that it then trickles down via higher prices and lower salaries.

Studies show that between 60% — 90% of the corporate tax is passed onto workers with the rest passed onto consumers and investors. Due to globalization, workers increasingly face a greater brunt of it because they have the fewest alternatives.

It’s never been easier for corporations to relocate to avoid a higher corporate tax, which is why I also support a 10% uniform tariff to counteract it, but nonetheless, we shouldn’t make our corporate tax too high because if corporations are going to exist then it’s better if they come home to Mama. Keep your friends close and your corporations closer.

Conclusion

With all this tax talk, let me be clear I support overall lower taxes. Here’s a good rule of thumb: any legislative bill that increases taxes in one area must be offset by a greater tax cut in another area.

This would mean that if the CBO projected my corporate tax to increase federal revenue as I suspect it would then in order for my reform to get my support the bill would need to include greater tax cuts elsewhere such as in personal income and payroll.

In the end, I believe in an America where we are once again a nation of family businesses, small investors, and innovative entrepreneurs instead of one where we are increasingly crushed under the weight of a few bureaucratic conglomerates who speak a da Chinese.