Should we raise $1 in taxes to cut $5 in spending?

Should Republicans and Democrats compromise by raising taxes and cutting spending in order to reduce the federal deficit?

I used to be sympathetic to this question, but now my answer is a firm: no.

For one, it’s difficult to calculate the actual spending-cut-to-tax-hike ratio. In 2011, Obama said he was offering 3-to-1 spending cuts, but the media said it was 2-to-1, some experts believed it was 1-to-1, and the GOP argued it was 1-to-4. It’s hard to reach a compromise when both sides believe they’re getting the short end of the stick.

But for the sake of argument, let’s say Republicans were convinced we’d get 5-to-1 then should we compromise?

Still no.

There’s the electoral factor. Both Eisenhower and H.W. Bush had extremely high approval ratings, but then they raised taxes in exchange for even larger spending cuts, which therefore in part caused their party to lose the next election to JFK and Clinton who then cut taxes anyway (Clinton raised taxes, said it was too much, and then cut taxes).

A tax cut means higher family income and higher business profits and a balanced federal budget. — John F. Kennedy

George H.W. Bush regretted breaking his pledge, “Read my lips: NO NEW TAXES!” because had he just put the Democrats’ proposed tax increase to the people as Newt Gingrich had suggested then he probably would’ve won reelection.

But I’m not one to advocate for public policies based on what’s politically expedient so let’s consider the third reason why Republicans should say no to an overall tax increase: economic growth. If you increase taxes you’re going to reduce economic growth from what it could’ve otherwise been because you’re likely taking productive capital out of the economy. The government turning around and spending it back into the economy, even if it's on unproductive ventures, at least in the short-term mitigates the growth reduction, but to tax and not spend eliminates the mitigation.

The fourth reason to make people read your lips is that it’s much easier to increase spending than cut taxes. How much has federal spending increased from 1960–2019: 51% in real terms and 4% relative to GDP. There’s a clear upward trajectory in both respects:

How much have taxes gone down? 0%. In fact, they’ve gone up by about the same percentage with the gap being made up via borrowing ($360,000 per person). This means with a spending-cut-to-tax-hike compromise we’ll likely see the spending cuts reversed and perhaps more quickly, now that politicians can point to a budgetary surplus as an excuse to splurge a little.

I think the most essential thing is to stop the increase in taxes… I’m in favor of cutting taxes anytime, any how, for any reason because the rule I believe is that government will spend whatever the tax system will raise plus as much more as it thinks it can get away with. — Milton Friedman

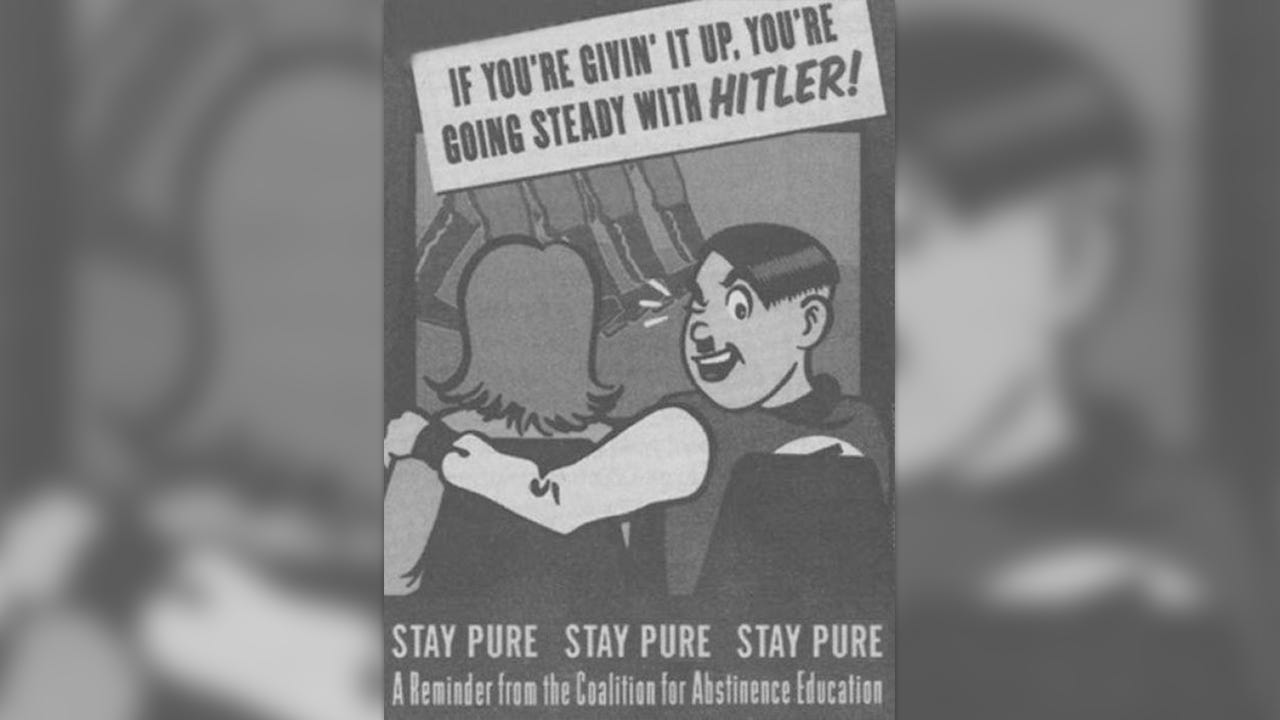

The fifth reason Republicans should say no to a tax increase is that they’ll lose their tax virginity. Once a politician loses their tax virginity it’s much harder for them to resist again in the future. They can try to justify it, but by compromising on what’s most Republicans' #1 priority — tax cuts — it means they’re more likely to compromise again as well as on other matters large and small. If we had legislative term limits or if it was easier to throw out politicians then this might be less of a concern, but the reality is that legislators have around a 90% reelection rate so it’s particularly important that we make Republicans sign the Taxpayer Protection Pledge before we elect them into an effectively lifelong position. Till death do us part?

But perhaps the most important reason why Republicans shouldn’t even support a 5-to-1 compromise is the existence of the Fed. During the 2008 financial crisis, the unelected Fed spent more money than our elected Congress.

The federal government spent $431 billion via TARP and $357 billion via ARRA whereas the Fed spent an estimated $7.7 trillion.

The only real check on the Fed’s spending is inflation where if it rises above 2% then they may try to reduce their spending if they feel it won’t do too much damage to the economy. They’re American shamans, but without the traditional pizazz.

Inflation can be reduced via raising rates (i.e. printing less money) or raising taxes.

Joe Biden’s account tweeted: “You want to bring down inflation? Let’s make sure the wealthiest corporations pay their fair share.”

Some conservatives pushed back on this because it would hurt the economy, but theoretically, his staff is correct to draw a connection because what makes money valuable is the labor it represents, therefore, if the Fed wants to print more without the dollar losing too much of its value then the government must inject into it more blood, sweat, and tears.

So with the existence of the Fed, what might’ve been a 5-to-1 compromise among our elected officials could instigate a downturn that causes our unelected officials to spend so much that government spending effectively turns into 0-to-1 or even -5-to-1.

In other words, you don’t compromise with a morbidly obese alcoholic by saying she can eat a little bit more than normal (taxes) in exchange for drinking a lot less than normal (spending) because come tomorrow her increased eating habit will continue, but her withdrawals may make her enabler Grandma Fed rush in with an even bigger bottle of vodka than before given that her symptoms are “so bad” and her additional weight gain means she can handle a greater percentage of alcohol.

And lastly, Republicans shouldn’t compromise by raising taxes because there are better compromises to be made. Republicans could agree to defense cuts for welfare cuts. We already spend more on the military than the next 11 countries combined and with Republicans becoming more non-interventionist again it only makes sense we should heed Eisenhower’s warning by reducing the military-industrial complex, which was arguably the primary way Eisenhower balanced the budget in 1960. Win-win.

A bit trickier compromise would be to raise taxes on unearned income to cut taxes on earned income. This should at least be tax neutral, but it’d function as a compromise because Democrats could go to their voters and say they raised taxes on rich investors like Warren Buffet while at the same time it should include spending cuts so Republicans can go to their voters and say they drained the swamp while both sides could proudly say they reduced the deficit and cut taxes on workers. Win-win.

And then finally, if Democrats refuse these common-sense compromises then Republicans could just win-win-win!

With a united government — House, Senate, Presidency — Republicans could implement Rand Paul’s 5 Penny Plan where we’d cut federal spending by just 5% and in 5 years we’d balance the budget. It’s that simple. I can think of a dozen ways to cut federal spending by 5% that doesn’t require touching the third rail of American politics (Social Security).

Republicans, unfortunately, failed to cut spending the last time they had a united government because Americans just weren’t libertarian enough, but today I think the middle-class is waking up to DC’s out-of-control spending and corruption. Politicians tend to be risk-averse sheep. We the shepherd must call out loud and clear: cut spending or face the slaughter!

Every Republican should be asked to repeat the immortal words of George H.W. Bush and then live by them or lose. You know we don’t have a tax problem when we can confiscate the wealth of every American billionaire and we still wouldn’t be able to run our federal government for more than 7 months. Let Republicans and Democrats come together to find areas in the budget to cut, but if Democrats refuse to act in good faith then Republicans must have the political courage to go it alone into that good night. Rage, rage against the dying of the light.