The Left and the Right often talk past each other on taxation even though there’s a lot of common ground.

We disagree on how high and progressive taxes should be, but we largely agree that unearned income (dividends, capital gains, pensions, and annuities) should be taxed at the same rate as earned income (wages, tips, salaries, net earnings) in an overall more simplified tax system.

If I could design my ideal tax system it would contain an income tax, but it would not be the kind of monstrosity we have now. It would be a flat rate tax on all income whatever source dervived less only a personal deduction and strict occupational expense. And that kind of an income tax I think would be the least inconsistent with a strong free enterprise system. — Milton Friedman

There was only one time in American history when unearned income and earned income were taxed at the same rate and it was after Ronald Reagan’s Tax Reform Act of 1986.

In 2010, the Simpson-Bowles report, which was a bipartisan Presidential Commission on deficit reduction created by Barack Obama, concluded that they should be taxed at the same rate again.

Currently, the Parties have become so polarized though that some Republicans want to cut unearned income taxes even more (Trump pledged to cut the top marginal rate of capital gains from 20% to 15%) whereas some Democrats want to raise it to an unprecedented level (Biden pledged to raise the top marginal tax rate of capital gains to 40%).

Like the Tax Reform Act of 1986, a compromise would be to raise the top marginal rate for the capital gains tax while cutting earned income taxes with fewer deductions/exemptions/subsidies/credits. Tax unearned and earned the same (T.U.E.S.)!

But If I could design my ideal tax system I’d replace the existing ordinary income tax, capital gains tax, payroll tax, death tax, NIIT, AMT, and virtually every deduction/exemption/subsidy/credit with a single Total Income Tax (T.I.T.).

On second thought, let’s just call it G.I.T. (Gross Income Tax).

G.I.T. would simplify our tax system.

G.I.T. would respect Americans’ freedom because instead of being forced to effectively work for the government for free by spending hours filling out paperwork it’d just take us minutes to do our taxes.

If a team is only as strong as its weakest link then our government is only as smart as its stupidest citizen. We need to make out government stupid simple so it’s conceptually easier for our lowest common denominator to hold our public servants accountable.

G.I.T. would increase unity.

The Left and the Right often talk past each other on taxation in part because I believe the rich want us to keep pointing our finger at the other side’s rich. Divide and conquer! Taxation (except for the 1%), regulation, spending, and debt continue to rise to unprecedented levels putting a tremendous burden on the Middle-Class while the rich can afford an army of lawyers and accountants to get around it, therefore, giving themselves a tremendous advantage in the marketplace.

With G.I.T., everyone will be on the same mountain and naturally the higher you are the greater the tax pressure. Most millionaires and billionaires are Democrats so one of the positives from a conservative perspective is that they wouldn’t sound as bullish about taxation if they were the ones having to pay for their “compassion.” Of course, some will still sound bullish because taxation is about power and so if a tax kills off some of their small business competitors then the surviving big businesses can charge higher prices on more customers.

G.I.T. wouldn’t disproportionally penalize hard work.

Since the Puritans, America has placed a lot of emphasis on work ethic. As George Washington once said, “Work shall set you free.”

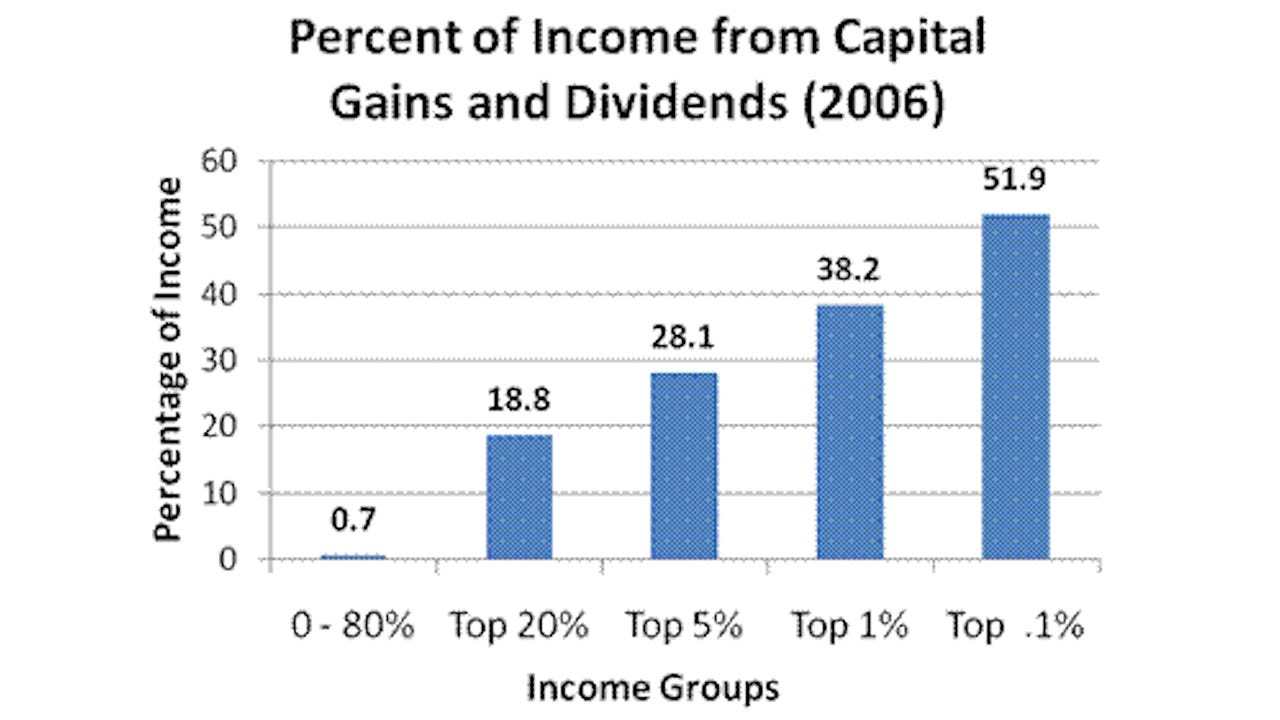

Work is what made the New World the leader of the world. According to studies, Americans’ continue to be the hardest working people on Earth, but too much of our effort is being funneled to the top because those at the top argue convincingly enough that the economy is better when they’re managing everyone’s money, but I don’t buy it. 54% of Americans live paycheck to paycheck. Give me a shovel and let me take my fate by my own two hands! Investors have their value, but fundamentally I believe the lion’s share should always go to the person actually doing the digging and so at the very least we shouldn’t structure our tax system around disproportionally penalizing the digger.

Now, whether G.I.T. would be implemented as an overall tax increase or decrease would depend upon the political bent of those in power at the time, but as a conservative, I’d prefer it to be implemented as an overall tax cut, in part, because the more popular a reform is at its outset the more likely it’ll stick around for a long-time to come.

Just to give you a back-of-the-napkin idea of how this reform would work let’s just consider the three biggest federal taxes (income, payroll, capital gains), which make up roughly 85% of federal revenue:

Payroll Tax: 15.3% tax is taken out of workers’ paychecks.

Capital Gains Tax:

Income Tax:

So let’s just consolidate those three taxes into one Gross Income Tax:

We could adjust the number of brackets and/or percentages to make it flatter and lower or vice versa.

As we collapse some of the other 94 taxes in the federal tax code into it then if we wanted to maintain federal revenue we’d have to increase the percentages a bit, which another benefit of G.I.T. is people will get a better sense of how much they actually pay in taxes. How much one pays in taxes should be made as painfully transparent as possible so taxpayers know just how much they’re being overcharged for the government services they receive.

But using my back-of-the-napkin brackets for G.I.T., workers would see a nice tax cut (including wealthy workers) whereas wealthy investors would see a tax increase.

Now, throughout the world, investments are generally taxed lower than labor income. The intellectual argument for lowering the capital gains tax is basically the same argument one makes for lowering any tax (double taxation, spurs economic growth, encourages entrepreneurship), but the argument here tends to be more successful because in politics the more vocal, wealthy, and niched a group is then the easier it is for them to get special privileges. The best intellectual case for keeping unearned income taxes disproportionally lower though is they’re easier to avoid, but I find that a feature not a bug because by collapsing into one tax it’ll apply downward pressure on a much broader tax base.

Got it? Now go on and git!