Kyle Kulinski vs. Paris Hilton: How High Should the Inheritance Tax Be?

One of the most popular leftists in America believes in a 99% inheritance tax…

Patrick Bet-David: How much of the Hilton family money should end up going to Paris?

Kyle Kulinski: I think that needs to be debated by the people and determined by the people, but if you're asking for my personal opinion I wouldn't go so far as some of the revolutionaries to say she should literally inherit nothing. I think that's too extreme, but I wouldn't lose a wink of sleep if she went from having $2.2 billion to $50 million.

Patrick: Really?! 99%?!

Kyle: Some people think of the economy as a meritocracy. I don’t buy that at all. I think your human value vs. your market value are totally separate things and we judge everything based on market value. So somebody like Paris Hilton… what has she contributed to the world? She's contributed nothing! And we're gonna feel bad if she inherits $50 million? The people that I'm concerned about are the people who are busting their *ss and getting absolutely nowhere… people who work two or three full-time jobs… and they don't make enough money to survive and so I think one of the best groups that you can tax in a society is rich dead people to give everybody else a chance.

I agree wealthy heirs should pay more, but 99% is insane… even for Paris Hilton.

“That’s hot.” — Paris Hilton

How high?

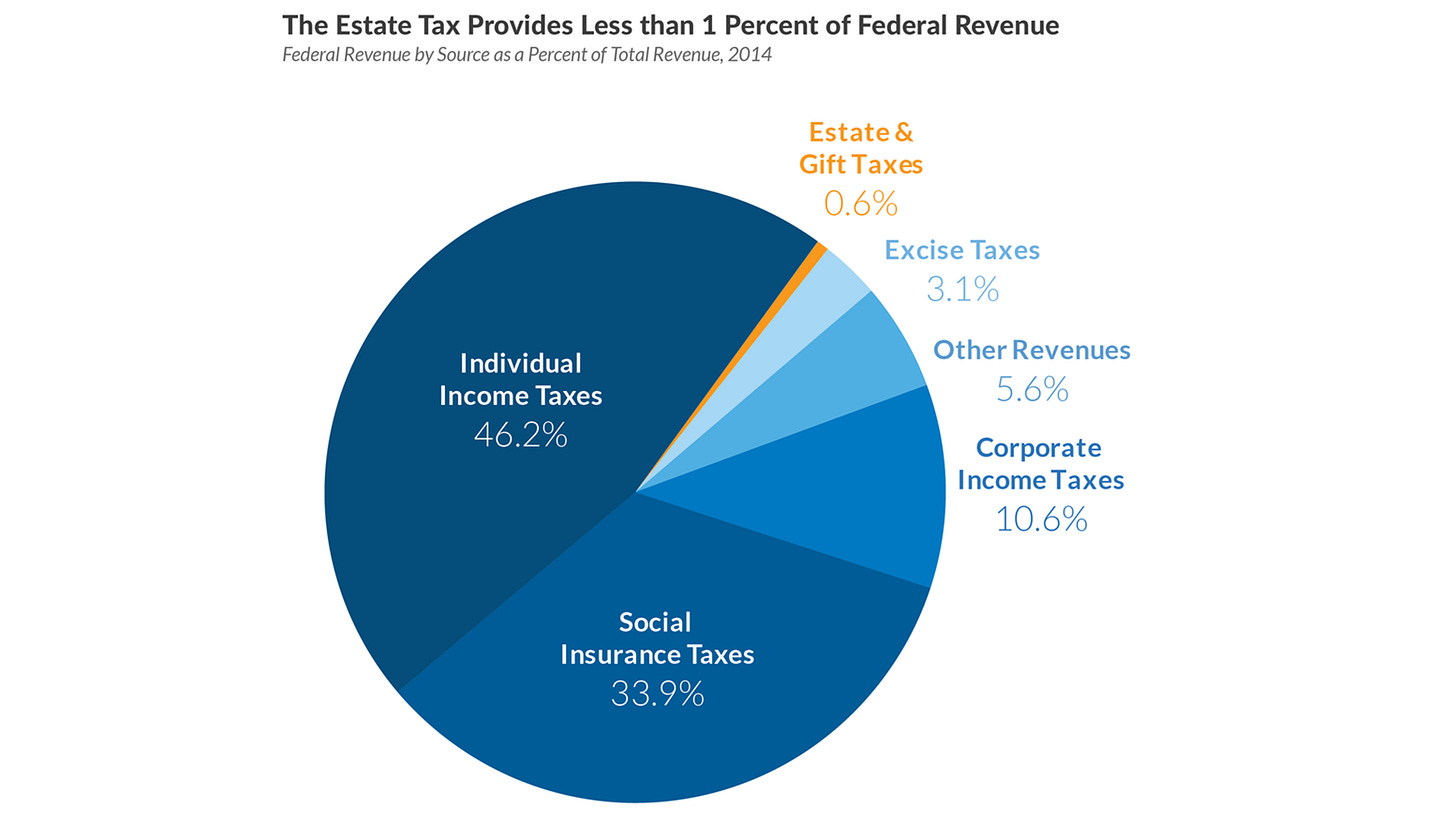

The federal government taxes inheritance via the estate tax, which individuals are allowed to give their heirs up to $13 million tax-free. Above that the top marginal rate is 40%. The estate tax produces about 1% of federal revenue.

Some argue we should abolish the estate tax because they see it as a double tax (individuals may have already paid income tax on it, which is more often not the case since most of it is a tax on unrealized capital gains) and a death tax (legalistically the tax falls on the deceased), but the estate tax is basically just a gift tax triggered by death via taxing the giver on behalf of the beneficiary since the beneficiary won’t have to pay a tax on it, but nonetheless, we can get around these criticisms by replacing the estate tax with an inheritance tax or better yet by simply taxing inheritance as income.

In my opinion, whether you make your money via earned income or unearned income you should pay the same rate.

More specifically, I believe in abolishing the payroll tax and then at most taxing the top 30% of the population’s income on a graduated rate to 30%.

Why not higher?

I wouldn’t go higher than 30% because the higher it is then the more lobbyists lobby politicians to give them special exemptions.

Once you pass an exemption for the poor then it’s easier to pass one for families then workers then teachers then doctors then small business owners, etc. so that when the dust settles you end up with a 7,000-page tax code where accountants and bureaucrats are suckling on its edges and the rich and powerful just so happen to have secured the biggest exemptions for themselves.

But let’s say we could maintain a high marginal tax without large exemptions then the rich and powerful will seek to avoid the tax altogether via a multitude of mechanisms, e.g. pay their heirs money and/or stock, give their heirs money and/or stock, put money in trusts, give money to non-profits, move money overseas, lobby so the tax also applies to small businesses so their own relative power (market share) increases, etc.

In the end, my top rate of 30% would generate a lot more inheritance tax revenue than our current 40% or Biden’s 61% or Bernie’s 77% or Kyle’s 99% because we’d be taxing a broader percentage of the population — it’s only fair that someone who received $1 million should pay at least as much as someone who earned $1 million — and I believe in taxing corporations whether for-profit or non-profit on 3% of their gross income.

A more philosophical reason I wouldn’t want to tax inheritance more than 30% is because I want to empower the family as a political unit.

A concept leftists struggle with is checks-and-balances.

They think centralizing power into our most inefficient alphabet-soup institutions will create more efficiency…

Kyle Kulinski: I don't like how we have so many layers of government where each one can tax you and they do different things. I'm a big fan of centralization in the sense that it should be the same rules in Kentucky as it is in New York.

But even if centralization did create more efficiency, it isn’t worth the enormous risk to our freedom, especially in an age of artificial general intelligence and mass surveillance.

With that said, if America was ruled more by a hereditary aristocracy then I’d be more sympathetic to a high inheritance tax, but America is ruled more by a corporate oligarchy.

According to the Billionaire Census, of America’s 600 billionaires 62% are self-made, 18% mixed, and 20% inherited. The data showed a “continuation of the long-term trend in the gradual increase in the proportion of self-made billionaires.”

At a time when our oligarchy has corroded the family unit I don’t think we should disproportionally penalize the family, in part, because it’s the biggest check on state power.

People will die for their family before they’d die for their country.

It’s this check that creates a more virtuous society since bonds are built more on love and trust rather than force.

It’s this check that leads to more Republican voters since the Republican Party is the party of the family. Billionaires tend to vote Democrat (25% of American billionaires gave to Biden vs. 14% to Trump), but billionaire families tend to vote Republican…

It’s also on the family-level where you’re best able to enact your political vision…

Patrick: There's a company called Ronald Blue that helps you set up estate planning and they’ll have a meeting with your kids and they'll say, ‘Listen, you guys are the Kulinski family, great job, your family has an estate. For you to participate in the estate you have to do XYZ. If you do then you’ll get this much by 30 years old, this much by 35, this much by 40, this much by 45, this much by 50.’ I think the parents who screw up with their money… their kid is not going to keep the money… it's not hard to spend $300 million… but if the parents have done proper estate planning then that kid has to keep working and doing things right to participate in a portion of that money.

I love the idea of estate planning because whereas many young leftists imagine forcing their political vision via the barrel of the gun on 49% of the population in the name of “equity,” I think they’d be better off imagining more of a state, local, and familial approach to politics because the closer you are to your locus of control than the more likely you are to succeed.

A family-first mentality welcomes true ideological diversity because even as Ben Shapiro says about himself, “I’m a communist in my own house.”

When you put family first, you can move out of a victimhood nihilistic mentality that bounces between delusions of grandeur by shifting to a far more masculine, rational, empowered optimism.

With that said, I’m even a little deluded on the familial level because I’d like to someday have a large family where I write a family constitution that would set out how my descendants could unlock money such as by turning 21 years old, running a marathon, watching all my videos, lifting their bodyweight, publishing a book, etc. The family constitution would be amendable and encourage each successive generation to at least replenish that which they got so that over time we’d have one of the most powerful American families.

Imagine how much stronger American society would be if there were tens of thousands of families like this creating bonds with each other based on trust and respect.

A final reason I wouldn’t tax inheritance more than 30% is because it’d hurt many small businesses.

Historically, virtually all businesses were passed down through the family where the Blacksmith family were literally blacksmiths.

Nowadays, about 40% of U.S. family-owned businesses transition into a second-generation business, 13% into a third-generation, and 3% into a fourth-generation.

A 99% inheritance tax would effectively kill family businesses, and if only applied to billionaires like the Hilton family then that means it’d only kill the most successful family businesses, therefore, leading to even more of a top-down hallowing out of personal responsibility since more companies wouldn’t be run by those whose name is on the building. Individuals and families care more about their long-term reputation than some hedge fund who can justify any morally questionable action as being done in the name of maximizing profit.

There’s definitely some who will be lazy with their inheritance, but inheritors tend to work more than non-inheritors. By the time individuals inherit money they’re often already successful adults with their own children, e.g. Paris Hilton.

“I’ve made all my money on my own without my family and I work very hard.” – Paris Hilton

And part of the reason people continue to work past their financial need to do so is in order to leave behind a bigger legacy, but if the government confiscated 99% of it then it’d make them and their family look foolish for having sacrificed so much only to then lose the fruits of their labor without so much as a thank you.

In the end, I think a 30-to-30 tax on labor, investment, and inheritance is a fairer way to not disproportionally penalize earned income nor family inheritance therefore leading to a society where we work hard and love harder.