Equal Tax for All: Should Everyone Have to Pay Their 'Fair Share'?

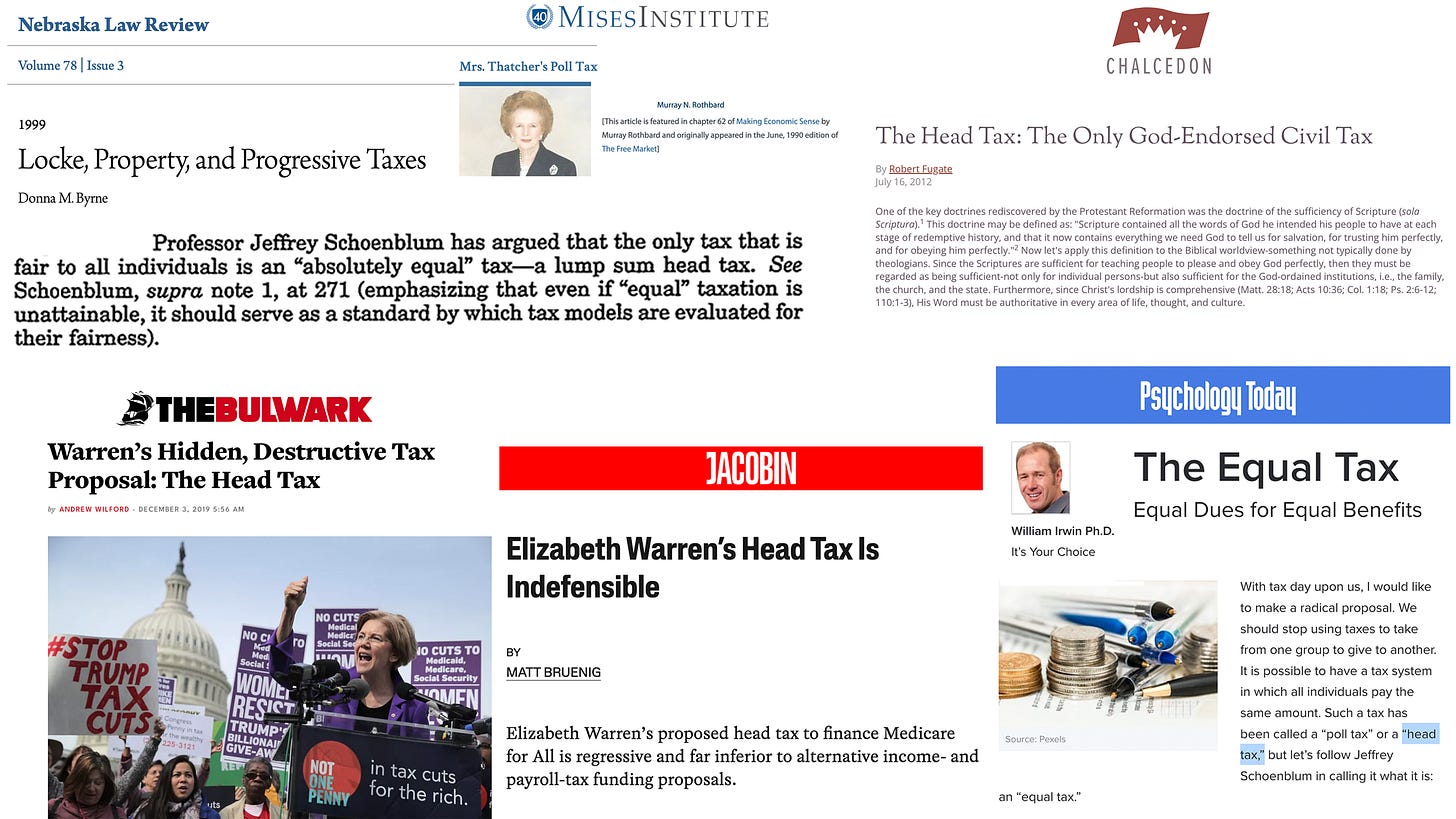

An equal tax or a head tax is a “tax levied as a fixed sum on every individual.”

I can see how it’s more appealing than a “flat” tax since it’s even flatter, but from what I could gather there’s never been a true head tax…

In the Bible (men over 20), Quran (except in dire poverty), Roman Empire (non-citizens), Canada & New Zealand (only on Chinese immigrants), Ceylon (adult men), Poland–Lithuania (only on Jews), Russia (except women, nobility, clergy, admin), United Kingdom (except in poverty), United States (to vote) and Seattle (on employees).

Once you introduce one exception then it’s easy to go down the slippery slope of introducing more.

The most common exception was for children, but don’t they benefit from public services too?

And doesn’t a true libertarian believe children should be allowed to work? Nonetheless, why shouldn’t their parents have to pay for their responsibility until they’re of age?

The most common exception in the American South was for non-voters, which would arguably make the tax “voluntary,” and therefore not “theft”? In theory, it could also lead to a more informed electorate since the poor who are disproportionally less informed would be priced out.

But in reality, I think our leftwing oligarchy would happily go from “ballot harvesting” to “head harvesting.” From a Machiavellian perspective, our oligarchy could strategically increase the poll tax to further drive out the middle and then exempt the poor.

Anyway, a voter head tax isn’t going to work in America due to the 24th Amendment so we might as well avoid the slippery slope altogether by focusing on a universal head tax…

My next problem with a universal head tax is it’d make the government too small, which was its central appeal to Murray N. Rothbard,

The great charm of equal taxation [head tax] is that it would necessarily force the government to lower drastically its levels of taxing and spending. Thus, if the U.S. government instituted, say, a universal and equal tax of $10 per year, confining it to the magnificent sum of $2 billion annually, we would all live quite well with the new tax, and no egalitarian would bother about protesting its failure to soak the rich.

I support public education, Social Security, an A+ infrastructure, strong borders, and having the #1 military in the world, which means his $35 head tax (adjusted for inflation) would be too small and it’s absurdly small when you consider that total government spending is currently about $30,000 per person.

My third problem with a head tax is that although people would be treated the same on the tax side they wouldn’t be treated the same on the benefit side.

The more property you own the more police it takes to protect it. The more business you do the more infrastructure required to facilitate it.

My fourth problem with a universal head tax ties into the semantics of “redistribution,” which is a dirty word for many of us on the Right.

Economic Redistribution: the transfer of income and wealth from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce, or tort law.

The truth is that most libertarians support redistribution because if you believe in forcing people to give money to the military then it doesn’t stop being redistribution simply because it’s a transfer you like. For example, what if on the condition of serving for 2 years you got a monthly pension of $2000 for the rest of your life? Does this no longer count as a transfer?

Once right-wingers realize they’ve already abdicated their principled stance against redistribution then there’s no point in supporting such a regressive tax under the ruse of being ideologically consistent.

The fifth reason I’m against a universal head tax is that although it’s simple in theory it’d be quite complex in enforcement.

Imagine the police state necessary to hunt down every single individual in America to pay this tax!

How are we even going to get money from people who have nothing? And after we raid their knapsack are we going to throw them in prison?

This would rightly lead to massive political backlash as virtually every celebrity would have their publicist take photos of them being whisked away by “the man” in solitary with their homeless brethren.

This would even create conflict within the libertarian camp between the head-taxers and the no-taxers therefore who’d even be left in society to defend this tax?

After two landslide reelections Margaret Thatcher implemented a head tax to fund local governments, but people rioted, she resigned, and it was repealed.

My final problem with a universal head tax stems from a more fundamental philosophical difference I have with heady libertarians…

They see property as the be-all-end-all whereas I see it for what it is: a means to an end.

Language or perhaps ideology fails to fully capture that end, but deep down we all want virtually the same thang: happiness, joy, eudaemonia; or we can put it in more quantifiable terms such as a higher median income or GDP growth.

Thomas Jefferson was wise to revise the ending of the Lockean triad from “property” to “the pursuit of happiness” because as a man who knew his way around a slave plantation he understood that the purpose of property is production just as the purpose of sex is reproduction.

RIP Sally Hemings

Most libertarians are not in favor of a strongly funded military. Of course, libertarians are on a sliding scale. I favor a strong domestic-based military that supports things like the border, able and ready to respond to threats from outside the country, but many libertarians don't even support that. They believe we could make due to militias.