Global Minimum Tax = Bad

A high corporate tax rate forces multinational corporations to move their headquarters overseas in order to stay price competitive with other multinational corporations, i.e. a “race to the bottom.”

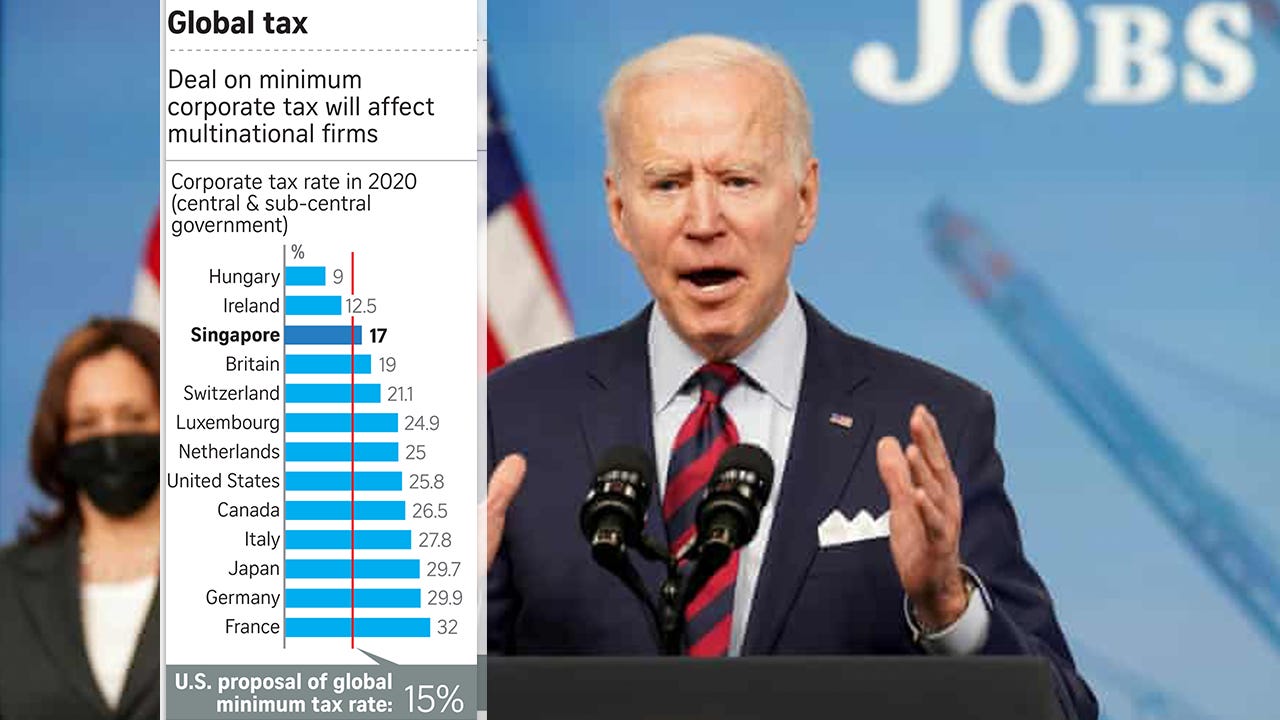

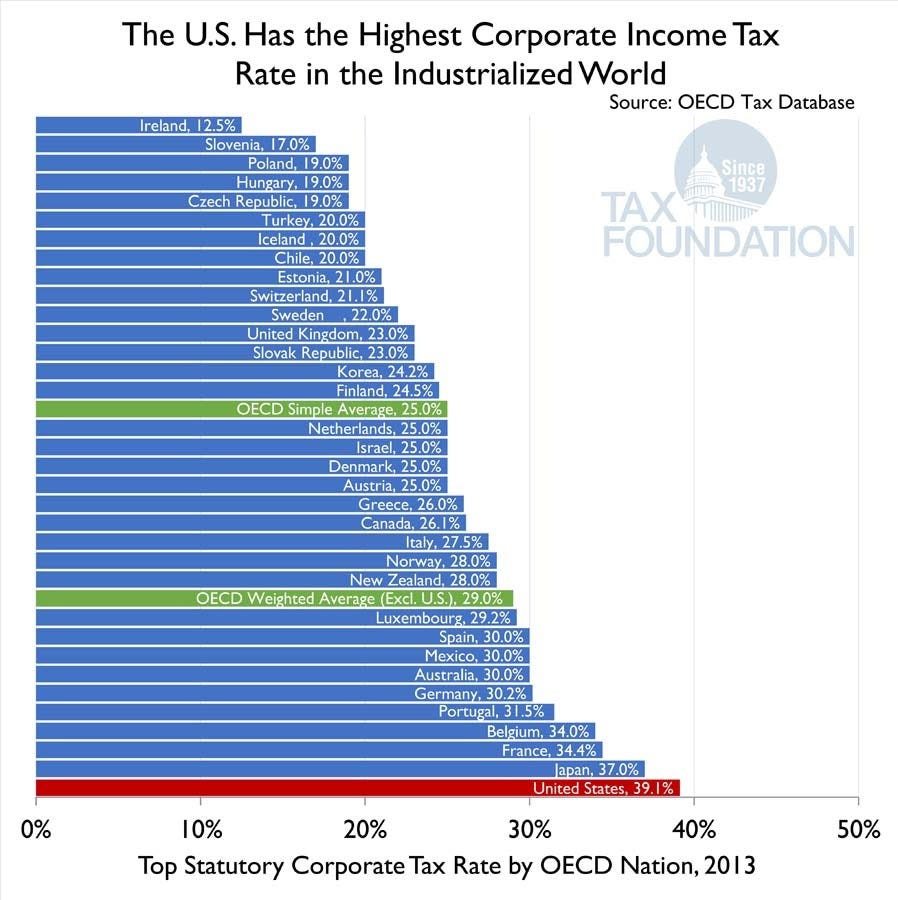

The U.S. had the highest corporate tax rate in the world until President Trump reduced it to a more competitive level.

Biden has proposed increasing it again, but his policymakers must be aware that unless the U.S. can force independent nations to get on board with raising their’s too then effectively Biden would be incentivizing the offshoring of even more of America’s economic capacity.

Introducing: Global Minimum Tax.

The G-7 recently endorsed a global minimum corporate tax rate of 15%.1

Treasury Secretary Janet Yellen called it a return to multilateralism and a sign that countries can tighten the tax net on profitable firms.

Tech companies, in particular, who have come to dominate global markets pay relatively little in taxes where they operate. Does this mean Big Tech is against a Global Minimum Tax?

Nick Clegg, Facebook Inc.’s vice president of global affairs, said the deal is a “step toward certainty for businesses” when it comes to taxes. An Amazon spokesperson called the agreement "a welcome step forward,” and a Google spokesperson said, "We strongly support the work being done to update international tax rules. We hope countries continue to work together to ensure a balanced and durable agreement will be finalized soon.”

When Big Tech supports a government action meant to curb its power then let that serve as a massive red flag.

Objectively, there are several reasons why a Global Minimum Tax Rate is a terrible economic policy…

For one, corporate taxes hurt workers. Studies show 51% of corporate-tax costs are passed directly on to workers. For every $1 generated for the government, 65¢ would be taken from workers’ wallets.

High corporate taxes divert capital away from the U.S. corporate sector and toward noncorporate uses and other countries. They therefore limit investments that would raise the productivity of American workers and would increase real wages. This is the cruel logic of a corporate tax in a global economy—that its burden falls most heavily on workers. — Mihir A. Desai, Harvard Business Review2

Two, to get the few small nations like Ireland who are beneath the 15% Global Minimum Tax to agree to it then the G-7 would have to threaten Ireland with penalties and tariffs to force her compliance. Imperialistic, eh?

Three, if a Global Minimum Tax was implemented, which would take years, and then assuming every nation on Earth agrees to it, then what is stopping nations from giving subsidies and tax exceptions to offset the rise of the corporate tax? If China gets on board with a GMT then you know this proposal is largely smoke-and-mirrors because their tech companies are effectively state-owned and heavily subsidized. To enforce the GMT somewhat fairly (completely fairly would be impossible) would require more global oversight and regulations, which big tech companies would be the best situated to take advantage of. If a GMT was implemented then I think Big Tech would become even more subsidized by taxpayers around the globe. In other words, corruption will rise!

But let’s put all that aside and assume the GMT would be implemented everywhere without any loopholes… I’d still argue it’d be a step in the wrong direction. It’s already easy enough for governments to take money from their citizens and businesses. We shouldn’t be building a global economic system around top-down force, but bottom-up freedom. Don’t compel obedience, but attract investment! The CEO of Microsoft has already warned us that we could live in 1984 world by… 2024. A GMT would be just one more step toward global authoritarianism. You’ve been warned.

With that said, taxes are necessary to any civilized society and I agree that the megarich (Bezos, Musk, Gates, Cook, Zucker, etc) are not contributing enough in taxes so what is a better alternative than a global minimum corporate tax?

Introducing: National Minimum Tariff

This is the exact sort of policy the megarich and the influence-industrial-complex hate, but it helped build the American Middle Class.3

I’m not suggesting we go back up to the 30% - 50% range we saw during the height of the Industrial Revolution, but what about a 5% or 10% minimum? And then for nations that suppress free speech, which threatens us all in our global economy (enter John Cena), we tack on an additional 5% to 10%?

On a global level, low tariffs make sense as it makes more productive/creative connections easier, and again, for the record, I believe in low tariffs as 10% is still within the historical low mark, but on a national level, if we want our fellow Americans’ wage to remain relatively high and for our production capacity to increase then we need to have some protection for our businesses to exist and disincentive for them to leave (incentivizing them to stay with subsidies is the worst of both worlds).

We’ve been miseducated by globalists and their underlings that tariffs are some brute instrument from a bygone era, but common sense will tell you that a strong country isn’t filled with indebted consumers as much as it's built by hardworking producers. Politicians should be production-focused rather than consumer-focused.

The UK had announced a digital service tariff on big US tech firms whereby the US retaliated by announcing a $2bn tariff on UK imports, but due to the G-7 meeting the tariffs were suspended, which I believe is a missed opportunity for both countries and a win for Big Tech.

Ultimately, rather than forcing the world to bend the knee, the American government should use the power it already has to stand up for its industry. Rather than change the world for the worst, let’s change ourselves for the better.

https://www.wsj.com/articles/g-7-nations-agree-on-new-rules-for-taxing-global-companies-11622893415?mod=article_inline

https://hbr.org/2012/07/a-better-way-to-tax-us-businesses

https://www.nationalreview.com/2021/01/end-the-tariff-taboo/