Abolishing the SEC: What It Means for Wall Street

The SEC is “an independent agency whose primary purpose is to enforce the law against market manipulation.”

Market manipulation is “conduct designed to deceive investors by artificially affecting the price of securities.”

The SEC was created in the aftermath of the 1929 stock market crash.

And who better to be its first chairman than arguably the greatest market manipulator of all time?

Joesph P. Kennedy Sr.

As chairman, he oversaw corporate financial disclosures, investigated investors, and perhaps most importantly propagandized Wall Street’s newfound safety, therefore, helping Wall Street regain its losses.

But I think we now have more than enough evidence to justify abolishing the SEC than had ever existed to justify creating it in the first place…

Abolishing the SEC would save taxpayers money.

The SEC’s 2023 budget is about $2 billion (Biden requested $2.4 billion).

It’d reduce regulatory costs.

The SEC’s regulations have increased significantly over time with major rules adopted every year that increase market uncertainty. As of 2021, SEC regulations are over 2,300 pages.

Large financial firms report that the average cost to maintain regulatory compliance is $10,000 per employee.

Since the passage of Dodd-Frank virtually no new banks have opened in the United States.

By abolishing SEC regulations we’d be lowering barriers to entry into the financial sector therefore increasing competition.

With greater competition comes lower costs.

If more stock exchanges popped up, smaller companies could afford to be publicly traded.

This decentralization of power from Wall Street would therefore increase the overall quality of the free market as exchanges, firms, banks, and companies would have to compete harder for each investment dollar.

By abolishing the SEC we’d increase society’s virtue as earned trust would supplant forced trust.

With earned trust, you have to build a reputation of honesty over many years with many people.

All it takes is one lie to destroy your credibility, which is why dueling was so prevalent in the 18th century culminating in the death of the “father of the US financial system.”

With forced trust, you just have to know the right people and fill out the right papers to get an official seal of approval so that no matter how sh*tty of a person you are people will still invest with you because their trust isn’t so much in you as a person as much as it’s in the government (i.e. force) to hold you accountable.

Abolishing the SEC would save voters’ time because it’d be one less commission you’re responsible for educating yourself on in order to be an informed voter. By freeing up your time you can devote more of it to improving your private life and/or studying other areas of our political system.

And finally, abolishing the SEC would strengthen our republic. One of the problems with a large administrative state is an agency can loosely interpret its parameters to pass broader bureaucratic decrees, i.e. mission creep, which diminishes our elected officials’ power and weakens our courts’ credibility since our courts have to subjectively decide if a decree is a “reasonable” derivative from the original law, which unfortunately the courts tend to err on the side of yes, i.e. Chevron’s deference.

The SEC’s mission creep is getting to such an absurd point that it has moved from regulating securities to regulating cryptocurrencies and carbon emissions.

92% of SEC employee donations also go to Democrats so abolishing the SEC would reduce the Democratic Party’s power to corrode our fragile republic.

You see, the SEC will never be big enough to oversee our $100 trillion financial sector and go after every corporation that breaks the law, which every single one of them does, so the SEC has to pick and choose who to enforce the rules against. Theoretically, it’d be the worst “market manipulators,” but in reality, political factors play a huge role, which then incentivizes corporations to lobby DC and bow to woke nonsense.

What will happen after we abolish the SEC?

Will we get stock market crash after stock market crash?

No, the financial sector was much more stable prior to the SEC.

Despite what the influence-industrial complex has taught us… the Great Depression wasn’t caused by too little regulation, but by too much of it via restricting branch banking, private deposit insurance, and the money supply.

In other words, the SEC was the wrong solution to the wrong problem.

With that said, by abolishing the SEC, I’m not recommending we decriminalize all forms of market manipulation.

If you believe in increasing the number of financial actions that count as such then perhaps it’d make sense to have a dedicated federal enforcement agency as the regulators and the regulated play cat-and-mouse with evermore exotic schemes that will further confuse the ultimate arbitrator… the American voter.

But beyond banning fraud I don’t see much of a case for banning much else.

For example, it’s on you if you fall for the pump-and-dump (assuming the schemers didn’t commit fraud by promising not to sell), or if you don’t have access to insider information (insider trading is inevitable; it’s only a question of whether you’re powerful enough to get away with it).

The problem with passing evermore laws to protect people from their own stupidity is people become stupider, i.e. moral hazard. In a democratic republic, we want individuals to disproportionally feel the impact of their bad decision-making so that they become more effective critical thinkers when they step into the ballot box.

With that said, by reducing the number of laws and abolishing the SEC it’d be easier to more universally and effectively go after fraud since fewer investigative resources would need to be pulled elsewhere and the financial market would have to better self-regulate in order to maintain investors’ trust since societies are naturally more trusting of government approval than they are of corporate approval.

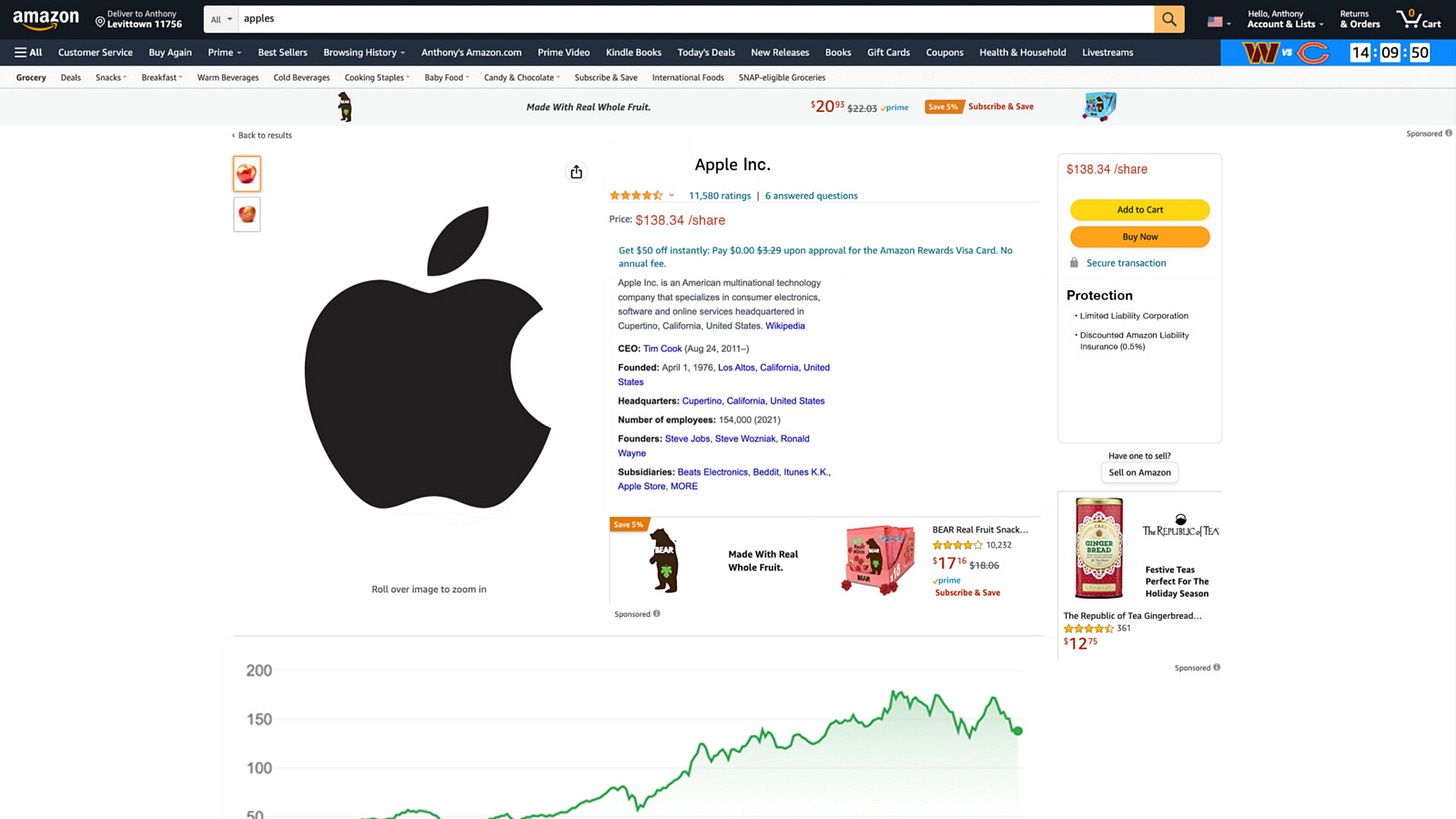

Finally, as we think of a future without the SEC we’d see the rise of more user-friendly stock exchanges.

Think Amazon but for stocks.

The Amazon Stock Exchange would require businesses who want to list with them to be transparent because only through increased transparency would people choose to invest their hard-earned money via the Amazon Stock Exchange into XYZ company.

Investors would also seek out more third-party reviewers to tell them whether they think a company is safe and smart to invest in, e.g. FINRA, Warren Buffet, WSJ, Deloitte, etc.

In the end, I believe in abolishing the SEC not because I’m pro-Wall Street and anti-regulation, but because I’m pro-Main Street and pro-self-regulation. If you support expanding the SEC because you’re a Machiavellian socialist then I can at least follow your logic, but every single republican capitalist should put their mouth where their money is by calling for the SEC’s RIP.