Why were there so many “panics” during the gold standard?

Nobel-prize-winning economist Paul Krugman wrote,

Under the gold standard, America had no major financial panics other than in 1873, 1884, 1890, 1893, 1907, 1930, 1931, 1932, and 1933. Oh, wait….returning to the gold standard is an almost comically (and cosmically) bad idea.

There were different stages of the gold standard (currency backed by gold), but economists consider the classical gold standard era from 1880–1914 to be its purest form because it wasn’t diluted like it was during the Civil War or later with the creation of the Fed.

For example, Fed Chairman Ben Bernanke blamed the Fed for the Great Depression (1930, 1931, 1932, 1933).

So let’s focus on the “financial panics” where everyone agrees the US was still on a true gold standard: 1884, 1890, 1893, 1907.

But before you panic, let’s define a panic…

A financial panic is a sudden, drastic, widespread economic collapse. All at once, many people become convinced their money or investments are at risk and rush to the institutions holding their assets.

During those years there were bank runs, which could’ve been mitigated by higher reserve requirements and/or deposit insurance, but was there “widespread economic collapse”?

1884–1886 yearly growth was -1.6%, 0.3%, 8.1%, which averages to 2.3%. This wasn’t a panic if you consider that it’s higher than the U.S. average from 1870–2018 of 1.67%.

1890–1892 yearly growth was 9%, 1%, 11%, which averages to 7%. If this constitutes a panic then I’ll take one now please!

1893–1895 yearly growth was -5.8%, -4.7%, 11.4%, which averages to 0.3%. This was a panic, but just as it’d be unfair to give monetary policy credit for everything good it’d be unfair to blame it for everything bad. When we actually dive into the details of this panic there are numerous factors that I’m sure even Krugman would acknowledge contributed to this recession, such as the massive railroad bubble popping (created by the US government’s easy lending policy), or the massive silver bubble popping (created by the US government’s buying policy), or the wheat bubble popping (not sure how much gov. gets the blame here, but for the sake of continuity let’s just say it does!), and the passage of a 50% increase in tax rates in the principal form of federal taxation at the time — the tariff.

1907–1909 yearly growth was 2.6%, -10.8%, 7.2%, which averages to -0.3%. The US experienced the 9th largest decline in the stock market, but the financial sector used to make up a much smaller percentage of the economy and of the top 20 drops, 19 of them have occurred after the Fed’s creation. This panic was quickly stomped out by J.P. Morgan who had convinced New York bankers to inject large sums of their own money into the banking system to shore it up. This panic led bank financiers to lobby for the Fed’s creation so that in future “panics” they wouldn’t have to risk their own money to save their own behinds.

As a comparison, 2007–2009 yearly growth was 1.9%, -0.1%, -2.5%, which averages to -0.7%, but unlike 1907, this panic massively increased our national debt and consolidated wealth into bigger-than-ever institutions and bubbles.

Now let’s look at the big macroeconomic picture…

From 1870–1914 US GDP growth was 393% whereas from 1970–2014 it was 242%. From this lens, the gold standard doesn’t sound like such a “comically (and cosmically) bad idea” after all.

A 1% difference is equal to $210 billion (adjusted for inflation) or roughly one Elon Musk.

Paul Krugman then argues in Golden Instability,

Anyone who believes that the gold standard era was marked by price stability, or for that matter any kind of stability, just hasn’t looked at the evidence.

I’ve looked at the evidence so Mr. Krugman’s claim is already incorrect, but quibbling aside, let’s look at the two charts he cited to support his claim…

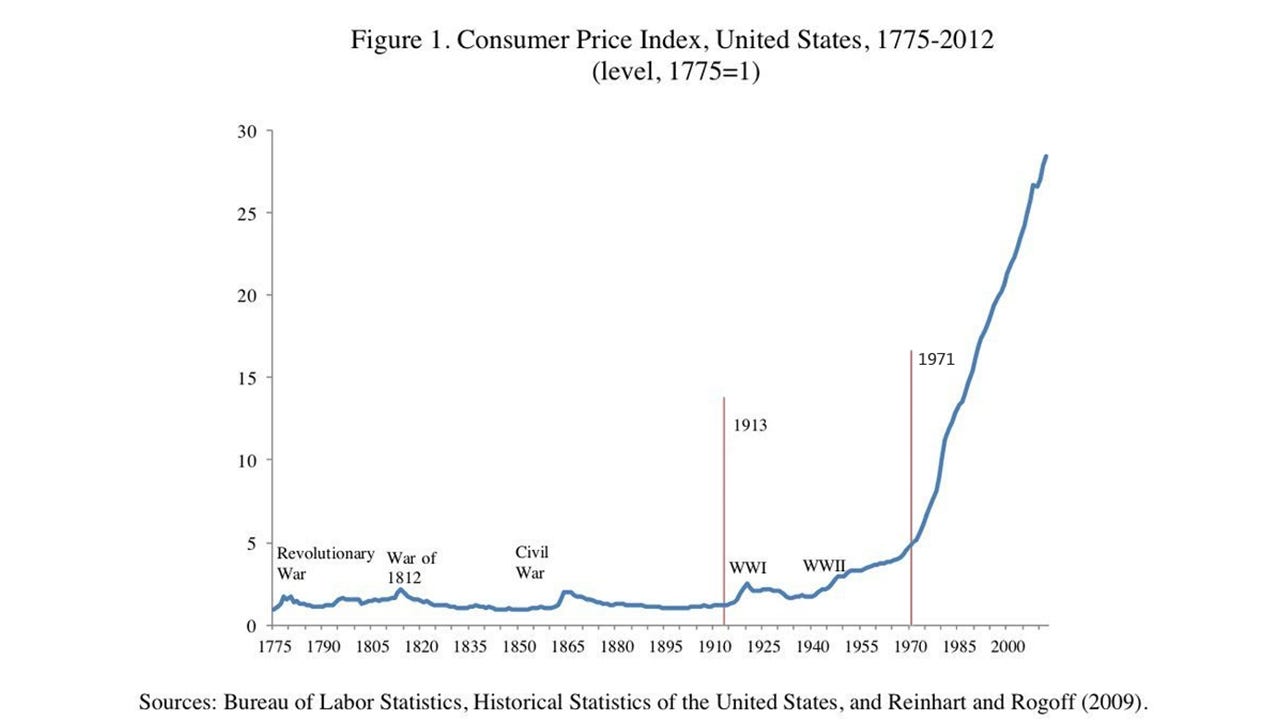

Besides the fact that America wasn’t under the classical gold standard anymore from 1919–1932, let’s look at the big picture to get a more accurate understanding of price stability…

Why didn’t America’s most-followed “top economist” (4.6M Twitter) cite the full picture? Clearly, prices were much more stable pre-1914, pre-1933, and pre-1971.

The final argument Krugman makes in his essay is that…

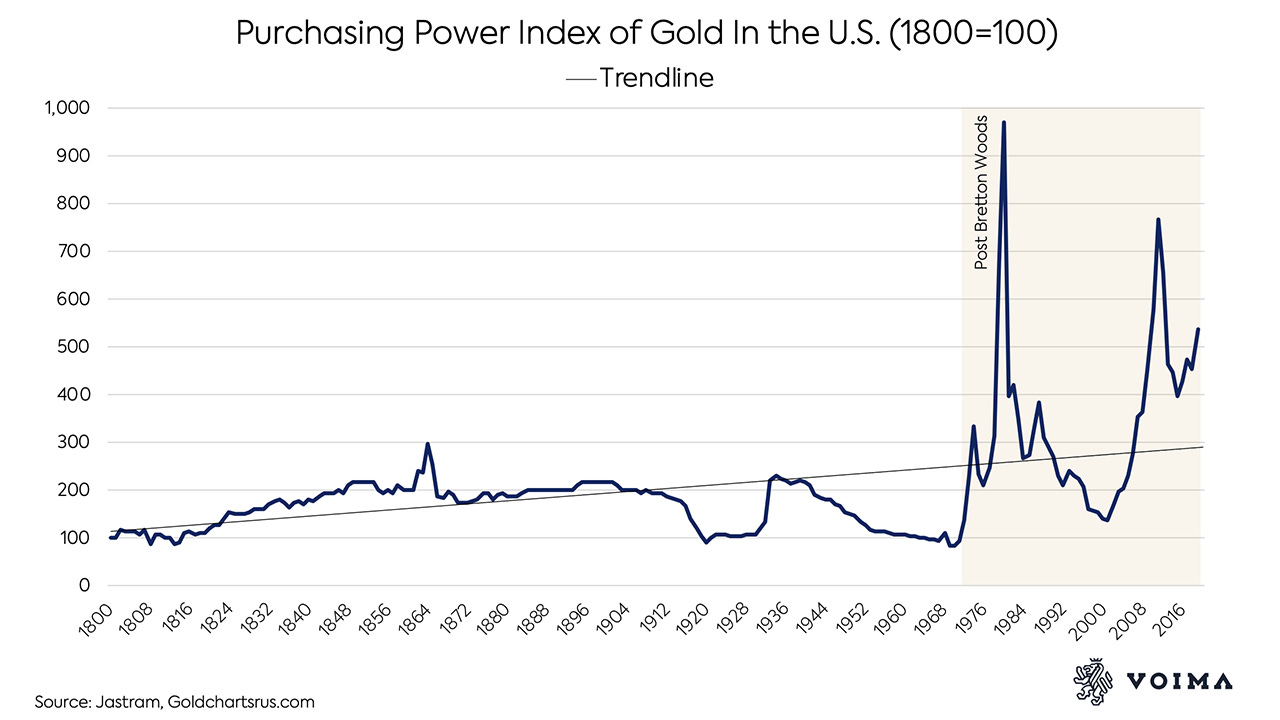

There is a remarkably widespread view that at least gold has had stable purchasing power. But nothing could be further from the truth. Here’s the real price of gold — the price deflated by the consumer price index — since 1968 (he provides following chart):

Can you spot why this is misleading?

Let’s look at the big picture…

In other words, he’s making an argument against the gold standard by only looking at gold prices post-gold standard.

The truth is that gold prices have fluctuated so greatly since Bretton Woods NOT because of gold itself, but as a reaction to the fiat dollar’s instability.

In the end, the only way Fed apologists can justify the Fed’s existence is to pretend like what came before it was a “comically (and cosmically) bad idea.”

They definitely can’t justify it on its own merits because the Fed has a dual mandate of “price stability” and “maximum employment” and we’ve already seen how it failed at price stability, but what about “maximum employment”?

We went from an era of full employment for virtually every able-bodied man (for better or worse women could afford to stay at home and raise their own children) to the lowest real employment in American history.

F + F = F

But there are two powerful groups who’ve benefited a lot from the Fed: bankers and bureaucrats.

The financialization of the economy has more than doubled from 4% to 10% with bigger bubbles than ever before. They’re so big because bankers know that when it pops the Fed will swoop in and try to save them, i.e. “too big to fail” leads to moral hazard.

And bureaucrats have benefited from the Fed because now their only constraint on spending is what they think is right. Paul Krugman is a big proponent of government spending because Keynesians believe massive deficit spending is an “investment” and can mitigate against downturns, but in reality, it primarily shifts money to less productive ventures and creates bigger bubbles down the road.

With that said, I think rather than a gold standard we should replace the Fed with a rule-based dollar to then compete on an equal playing field with gold, silver, and crypto as tax-free legal tender currencies.

In other words, I support free-market money.

My problem with a gold standard is it’s less desirable than gold itself. As goldbug Mike Maloney said, “gold standards suck” and Milton Friedman said,

Those people who say they believe in a gold standard are fundamentally being very anti-libertarian because what they mean by a gold standard is a governmentally fixed price for gold.

Second, even if we could implement a gold standard that was the greatest thing since… well, gold… then history shows that it may just be diluted by “experts” like Krugman at the next politically opportune moment (war/recession). Third, the gold standard puts too much power in one commodity. With free-market money, our financial system wouldn’t be too dependent on any one commodity or currency.

But in the end, it’s clear that our classical gold standard was better than our current fiat standard in terms of growth, stability, and employment. History is written by the victors, but despite what the Fed would like us to believe, our great-grandparents weren’t in a constant state of panic whereas it sure seems like we are today for reasons that manifest in the financial and spread out to the soul.