Why Georgism Is Wrong (Part 2)

Here’s some common critiques I received on my previous essay…

Georgism is just a land value tax, bro.

No, land value taxes were advocated for (Adam Smith, Thomas Spence, David Ricardo, Mill, Mrs. Fawcett, Francois Quesnay, Anne Turgot, etc.) and existed long before Henry George. And today some countries have LVT, but no one considers them Georgist (Denmark, Singapore, Taiwan).

Georgism can be more than one tax so long as it’s a tax on negative externalities and/or rent-seeking!

No, Henry George wasn’t a Neanderthal. He existed during the 2nd Industrial Revolution when we had all sorts of taxes in part to disincentivize their usage like on whale oil, coal gas, horse-drawn carriages, sugar, alcohol, tobacco, etc. yet Henry George and the “single tax movement” advocated for repealing them all in favor of a single tax.

The most fundamental of all reforms, the reform which will make all other reforms easier, and without which no other reform will avail, is to be reached by concentrating all taxation into a tax upon the value of land, and making that heavy enough to take as near as may be the whole ground-rent for common purposes. — Henry George, Social Problems (1883)

Land can't run away; it can't be hidden; it lies out of doors; its value can be estimated with more certainty than any other value. And in putting taxes upon that single item we shall get rid of a horde of officials; we shall get rid of all these oaths that people in every direction are now required to take, of all the temptations to perjury that our present laws give, and shall raise our revenue without imposing any restriction upon production or diminishing it in the least. — Henry George, What We Stand For (1887)

We propose to abolish all taxes save one single tax levied on the value of land, irrespective of the value of the improvements in or on it. — Henry George, The Single Tax (1890)

Georgism can be a low-rate LVT!

No, Henry George said the full value should be taken…

Taxes may be imposed upon the value of land until all rent is taken by the State, without reducing the wages of labor or the reward of capital one iota; without increasing the price of a single commodity, or making production in any way more difficult. — Henry George, Progress & Poverty (1879)

These are the plain, simple principles for which we contend, and our practical measure for restoring to all men of any country their equal rights in the land of that country is simply to abolish other taxes, to put a tax upon the value of land, irrespective of the improvements, to carry that tax up as fast as we can, until we absorb the full value of the land, and we say that that would utterly destroy the monopoly of land and create a fund for the benefit of the entire community. — Henry George, The Land for the People (1889)

Tax land values all you please up to the point of taking the full annual value—up to the point of making mere ownership in land utterly unprofitable, so that no one will want merely to own land—what will be the result? Simply that land will be the easier had by the user. Simply that the land will become valueless to the mere speculator. — Henry George, Justice the Object - Taxation the Means (1890)

More quotes in the comments.

Georgism is “an economic philosophy holding that the economic value derived from land, including natural resources and natural opportunities, should belong equally to all residents of a community, but that people own the value that they create themselves.”

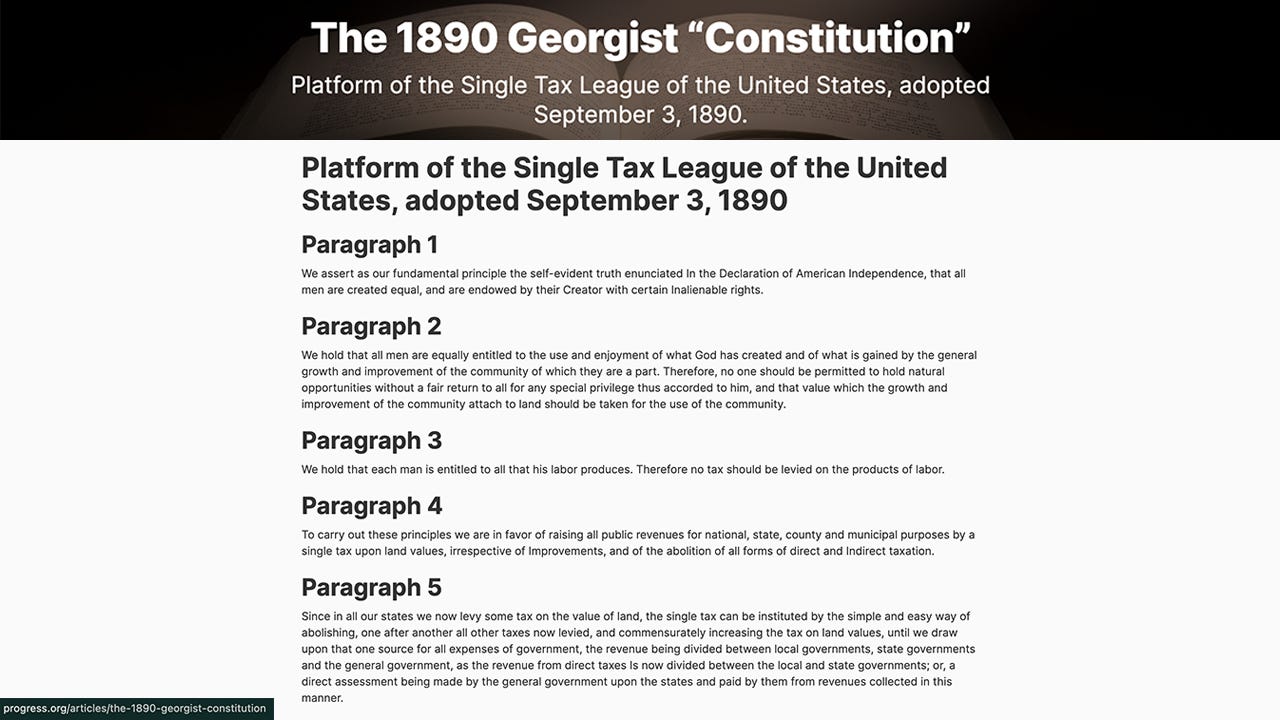

This definition is similar to the 2nd paragraph of the Georgist platform (written by Henry George), but ignores 1 & 3+.

We assert as our fundamental principle the self-evident truth enunciated In the Declaration of American Independence, that all men are created equal, and are endowed by their Creator with certain Inalienable rights.

We hold that all men are equally entitled to the use and enjoyment of what God has created and of what is gained by the general growth and improvement of the community of which they are a part. Therefore, no one should be permitted to hold natural opportunities without a fair return to all for any special privilege thus accorded to him, and that value which the growth and improvement of the community attach to land should be taken for the use of the community.

We hold that each man is entitled to all that his labor produces. Therefore no tax should be levied on the products of labor.

To carry out these principles we are in favor of raising all public revenues for national, state, county and municipal purposes by a single tax upon land values, irrespective of Improvements, and of the abolition of all forms of direct and Indirect taxation.

I get not defining Georgism by paragraph 1 because it’s too abstract and broad.

But so is just defining Georgism by paragraph 2 because its definition can be stretched to such an extent as to justify whatever is one’s own concrete policies, e.g. “meat is natural so we should put a high sales tax on it, UBI is the only legitimate Georgist position because it’s the only way to redistribute equally, businesses can be taxed directly because they aren’t people, licensing fees for fishing/farming/construction, etc.”

Fortunately for our qualitative purposes, Georgism makes very clear for even the most dense person it’s about a single high land value tax where from the 3rd paragraph on, the platform explains how it’d work and what it believes the positive implications would be.

LVT is a tax on rent price (aka capitalization rate), not sale price!

According to the Georgist platform, LVT can be based on “purchase money or rent:”

Paragraphs 7 & 8:

It is a tax, not on land, but on the value of land. Thus it would not fall on all land, but only on valuable land and on that not in proportion to the use made of it, but in proportion to its value—the premium which the user of land must pay to the owner, either in purchase money or rent, for permission to use valuable land. It would thus be a tax, not on the use or improvement of land, but on the ownership of land, taking what would otherwise go to the owner as owner, and not as user.

In assessments under the single tax all values created by individual use or improvement would be excluded and the only value taken into consideration would be the value attaching to the bare land by reason of neighborhood, etc., to be determined by impartial periodical assessments. Thus the farmer would have no more taxes to pay than the speculator who held a similar piece of land idle, and the man who on a city lot erected a valuable building would be taxed no more than the man who held a similar lot vacant.

And out of the two, basing LVT on the “purchase money” is more common and I’d argue better…

More common:

Virtually every mainstream source you can find talks about LVT as a tax on the average sale price of land that is either arrived at by looking at the literal sale of a raw plot of land and/or looking at the sale price of a home and then simply deducting the improvement costs.

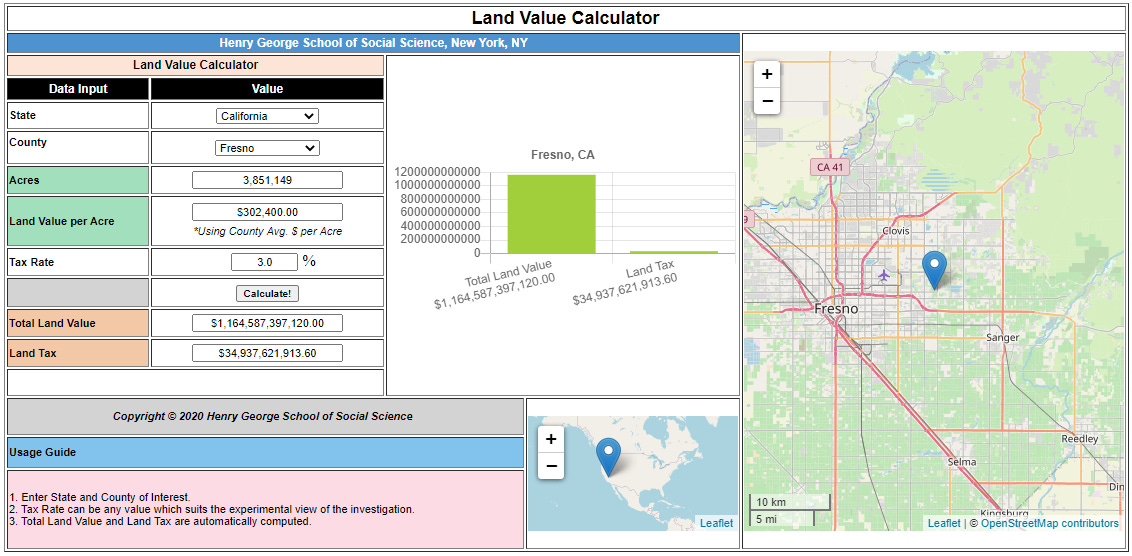

Even the Georgist School of Social Science cites according to the sale price:

And when Henry George or modern Georgists point to governments that had or have LVT they commonly point to governments that have assessed based on the sale price.

Better:

The average person doesn’t even know what the capitalization rate means, which is a modern term:

Capitalization Rate = Net Operating Income / Sale Price

This added variable creates more complexity and subjectivity, which can lead to more abuse.

If it’s apparently so complex that I and the Georgist School of Science don’t understand it then don’t you think as a matter of principle we the rulers shouldn’t implement rules we don’t understand?

And what is “net” income?

If a landlord made $10,000 a year under the status quo and then we implemented a 100% tax on it then the landlord could claim the $10,000 as “expenses,” e.g. energy, maintenance, depreciation, repairs, security, office hours, entertainment, etc. so that just as with Fortunate 500 companies that have huge revenues and pay virtually no corporate income tax a landlord could also claim to have no profits.

If landlords’ profits also became the sole barometer for our tax system then for one homeowners who vastly outnumber landlords’ would vote to implement rent control or ban it altogether to keep down their own tax liability while landlords’ would also form organizations to try to lobby the government to allow for as much expensing as possible.

And then finally, the idea of Georgism is to massively increase housing so that effectively no one would want to be tenants anymore because why would you choose to pay extra to someone who literally does nothing (if he does something then by definition this doesn’t count toward LVT since it’s supposed to only tax land)?

So then how could we base a single tax on the “capitalization rate” when there would theoretically be no more capitalization?!

In the end, Georgists would be forced to move away from basing such a land value tax on a non-existent income so you might as well not argue for it from the start.

All Taxes Come Out of Rent (ATCOR)!

No. Let’s just run through a simple mental experiment…

Scenario A:

Adam plants apple trees.

He sells his apples for a large profit.

His land’s value goes up.

Scenario B:

But what if Adam is Apple?

It sells its iPhones for a large profit.

Apple’s land’s value goes up.

But then Apple moves its manufacturing overseas to where there is no LVT and because Georgism opposes tariffs it’d make offshoring even more profitable.

Scenario C:

Adam plants apple trees.

He sells his apples for a large profit.

His land’s value goes up.

But because we’re in the metaverse the land is virtual!

People are buying virtual apples with real money so that when Adam stems out of the metaverse he has more money in his bank account, but the physical land beneath his condo doesn’t increase.

Shut up! ATCOR is a theory supported by real economists so how dare art thou question thy authority!

If you’re the type of person who’s easily persuaded by ad hominem attacks then “NO YOU’RE THE POOPY FACE!” or if you’re easily persuaded by appeals to authority then logically you can’t be a Georgist because for every 1 Georgist economist there are 999 who aren’t.

For example, I think the greatest economist of the 20th century was Milton Friedman and although like me he supported a low-rate LVT, he never considered himself a Georgist.

If we all support LVT then why fight each other? Unity over division! It’s the best way to advance the cause!

I agree that on the net we should strive to find common ground, but the greatest political achievements weren’t advanced by suppressing dissent in the name of politeness or expediency.

Debate is the bedrock of democracy.

We air out our differences in a rational way so that we may persuade where we can and compromise where we must.

So as to my motives for attacking Georgism it’s because…

One, I’m an originalist. I believe words have meaning based on what they were commonly understood at the time of their adoption and shouldn’t slowly lose their meaning because later “experts” are too cowardly & opportunistic to openly disagree with them so they try to redefine them to advance their own agenda.

Second, and counterintuitively, I respect Mr. George enough to say that thou shalt not co-opt his name to dismiss his central proposition. If you think he’s wrong then have the decency to say so rather than pretend like if only he knew what you know he’d abandon his cause for yours. After a single word in the 11th paragraph of the above platform was changed, Henry George stopped attending their conferences so what makes you think he’d be any less headstrong today?

The third reason and perhaps a big reason why you’ve read this far is it’s fun to battle it out in the arena of ideas and explore policies to then delineate where our own thoughts lie so that over time we as individuals can form our own strong coherent worldview.

Fourth, I wish to prevent radicalization because if you identify as something then those who identify as the purest version of it will have the intellectual upper hand so that after you enter the door as a moderate you can quickly find yourself pressured using the internal logic of said philosophy to eventually accept its wholesale prescription.

Fifth, and the main reason I’ve attacked Georgism is because it’s homosexual.

Jk, the main reason is because it’s a diversion from the main solution to our housing crisis. Home prices aren’t exorbitant so much because of a lack of housing supply (16 million vacant US homes) as much as because of too much money supply. In other words, because the government has prohibited money from retaining its value people are forced to find something else that will serve this role: real estate. I support a low-rate LVT, housing deregulation, and a new Homestead Act to increase home ownership, but ultimately if we believe in the concept of ownership then fundamentally that means we shouldn’t print nor tax it away.

Fine! You’re right, I’m technically not a Georgist, but then under what banner can those of us who support LVT unite under?

If you google Georgism you’ll see that just about every definition includes the qualifier “also called Geoism” so I think for those of us who support a low-rate LVT as one tax among many then we could go with something as straightforward as “LVT supporter,” but if we’re looking for something more pretentious then we could call ourselves Geoists (prefix means “land”).

We could also tack geo- onto whatever else we are, e.g. geoliberal, geoconservative, geosexual.

I like this geo- approach because it’s more flexible and doesn’t put any one LVT supporter on a pedestal nor are you put in the odd position of calling yourself a Georgist while never having read one of his books.

But nonetheless, if you really want to unite around a personality then I recommend Gallist because I suppose I have one advantage Henry George doesn’t.

I pay tax for the land I use.

RIP.

Thanks for reading!

Here’s some additional quotes I found of him supporting a single full land value tax…

Progress & Poverty (1879)

“It is difficult for small farmers and homestead owners to get over the idea that to put all taxes on the value of land would be unduly to tax them.”

“When it is first proposed to put all taxes upon the value of land, and thus confiscate rent, all land holders are likely to take the alarm, and there will not be wanting appeals to the fears of small farm and homestead owners, who will be told that this is a proposition to rob them of their hard-earned property. But a moment's reflection will show that this proposition should commend itself to all whose interests as land holders do not largely exceed their interests as laborers or capitalists, or both.”

“There need not have been a customs duty, an excise, license, or income tax, yet all the present expenditures could be met, and a large surplus remain to be devoted to any purpose which would conduce to the comfort or well-being of the whole people.”

“All peoples have recognized the common ownership in land, and that private property is an usurpation, a creation of force and fraud.”

“We already take some rent in taxation. We have only to make some changes in our modes of taxation to take it all.”

“We may put the proposition into practical form by proposing— to abolish all taxation save that upon land values.”

“But this is so natural and easy a matter, that it may be considered as involved, or at least understood, in the proposition to put all taxes on the value of land.”

“There are the temporary monopolies created by the patent and copyright laws. These it would be extremely unjust and unwise to tax, inasmuch as they are but recognitions of the right of labor to its intangible productions, and constitute a reward held out to invention and authorship.”

“It is much better that these monopolies should be abolished.”

“Businesses which are in their nature monopolies are properly part of the functions of the State, and should be assumed by the State. There is the same reason why Government should carry telegraphic messages as that it should carry letters; that railroads should belong to the public as that common roads should.”

“Tax manufactures, and the effect is to check manufacturing; tax improvements, and the effect is to lessen improvement; tax commerce, and the effect is to prevent exchange; tax capital, and the effect is to drive it away. But the whole value of land may be taken in taxation, and the only effect will be to stimulate industry, to open new opportunities to capital, and to increase the production of wealth.”

“In countries like the United States there is much valuable land that has never been improved; and in many of the States the value of the land and the value of improvements are habitually estimated separately by the assessors, though afterward reunited under the term real estate.”

“The effect of substituting for the manifold taxes now imposed a single tax on the value of land would hardly lessen the number of conscious taxpayers, for the division of land now held on speculation would much increase the number of land holders.”

“The elder Mirabeau, we are told, ranked the proposition of Quesnay, to substitute one single tax on rent (the impôt unique) for all other taxes, as a discovery equal in utility to the invention of writing or the substitution of the use of money for barter."

“The needle of the seamstress and the great manufactory; the cart-horse and the locomotive; the fishing boat and the steamship; the farmer's plow and the merchant's stock, would be alike untaxed. All would be free to make or to save, to buy or to sell, unfined by taxes, unannoyed by the tax-gatherer. ”

“the effect of putting all taxation upon the value of land would be to relieve the harder working farmers of all taxation.”

“Thus to put all taxes on the value of land, while it would be largely to reduce all great fortunes, would in no case leave the rich man penniless.”

Social Problems (1883)

“Indirect taxation, the other device by which the people are bled without feeling it, and those who could make the most effective resistance to extravagance and corruption are bribed into acquiescence, is an invention whereby taxes are so levied that those who directly pay are enabled to collect them again from others, and generally to collect them with a profit, in higher prices. Those who directly pay the taxes and, still more important, those who desire high prices, are thus interested in the imposition and maintenance of taxation, while those on whom the burden ultimately falls do not realize it. The corrupting effects of indirect taxation are obvious wherever it has been resorted to, but nowhere more obvious than in the United States.”

“While every citizen may properly be called upon to bear his fair share in all proper expenses of government, it is manifestly an infringement of natural rights to use the taxing power so as to give one citizen an advantage over another, to take from some the proceeds of their labor in order to swell the profit of others, and to punish as crimes actions which in themselves are not injurious.”

“All it is necessary to do is to abolish all other forms of taxation until the weight of taxation rests upon the value of land irrespective of improvements, and take the ground-rent for the public benefit.”

“And in doing this we could abolish all other taxation, and still have a great and steadily increasing surplus.”

“Practically, then, the greatest, the most fundamental of all reforms, the reform which will make all other reforms easier, and without which no other reform will avail, is to be reached by concentrating all taxation into a tax upon the value of land, and making that heavy enough to take as near as may be the whole ground-rent for common

purposes.”

“To appropriate ground-rent to public uses by means of taxation would permit the abolition of all the taxation which now presses so heavily upon labor and capital.”

“It would utterly destroy land monopoly by making the holding of land unprofitable to any but the user. There would be no temptation to anyone to hold land in expectation of future increase in its value when that increase was certain to be demanded in taxes.”

The Science of Political Economy (1898)

“The first one to use the term is said to have been Antoine de Montchretien in his “Treatise on Political Economy” (“Traite' de l’e'conomie politique”), published in Rouen, France, 1615. But if not invented by them, it was given currency, some 130 or 140 years after, by those French exponents of natural right, or the natural order, who may to-day be best described as the first single-tax men.”

“That Quesnay and his associates saw the enormous significance of this “net product” or “unearned increment” for which our economic term is “rent,” is clear from their practical proposition, the impot unique, or single tax. By this they meant just what its modern advocates now mean by it—the abolition of all taxes whatever on the making, the exchanging or the possession of wealth in any form, and the recourse for public revenues to economic rent; the net or surplus product; the (to the individual) unearned increment which attaches to land wherever in the progress of society any particular piece of land comes to afford to the user superior opportunities to those obtainable on land that any one is free to use.”

“the benefit which would result from the perfect freedom given to industry and trade by a substitution of a tax on rent for all the impositions which hamper and distort the application of labor, was doubtless as clearly seen by them as it is by me.”

“Afterwards, with the great idea of the natural order in my head, I printed a little book, “Our Land and Land Policy,” in which I urged that all taxes should be laid on the value of land, irrespective of improvements. Casually meeting on a San Francisco street a scholarly lawyer, A. B. Douthitt, we stopped to chat, and he told me that what I had in my little book proposed was what the French “Economists” a hundred years before had proposed.”

“Even if Adam Smith had seen the place of the single tax in the natural order, as the natural means for the supply of the natural needs of civilized societies, prudence might well have suggested that his inquiry should not he carried so far. I mean, not merely that prudence of the individual which impelled Copernicus to withhold until after his death any publication of his discovery of the movement of the earth about the sun; but that prudence of the philosopher which, from a desire to do the utmost that he can for Truth and Justice in his own time, may prevent him from advancing a larger measure of truth than his own time can receive.”

“Thus H. M. Hyndman has dug up from the British Museum a lecture by Thomas Spence, delivered before the Philosophical Society of Newcastle, on November 8, 1775, a year prior to the publication of the “Wealth of Nations,’ and for which the Society, as Spence puts it, did him “the honor” to expel him. In this lecture Spence declares that all men “have as equal and just a property in land as they have in liberty, air, or the light and heat of the sun,” and he proposes what now would be again called “the single tax”—that the value of land should be taken for all public expenses, and all other taxes of what ever kind and nature should be abolished. ”

Substack apparently limits the word count in comments so I'll have to share the rest elsewhere: https://qr.ae/pssaEH