A Land Value Tax Is the Future

A Land Value Tax (LVT) is a tax on the unimproved value of land.

LVT is favored by a wide array of economists: libertarian Milton Friedman who called it “the least bad tax,” Adam Smith (“The Father of Capitalism”), Thomas Paine, David Ricardo, Paul Samuelson, and socialist J. Stitt Wilson.

The tax upon land values is the most just and equal of all taxes. — Henry George, political economist

Since WW2, 80% of the developed world’s rising house prices are due to rising land values.

Economists prefer the Land Value Tax because land is just about the only commodity that’s essentially fixed, which means the tax cannot be passed onto tenets because a landlord would’ve already been charging the maximum profit they think they could get. In other words, a Land Value Tax doesn’t suffer from the same problem of other taxes where if you increase a tax on a good/service it means fewer companies can afford to start or stay open which means less supply and therefore higher prices. Since the amount of land is fixed, a Land Value Tax is a genuinely progressive tax, in that the owners of valuable land pay more, which therefore reduces inequality.

LVT also reduces land speculation.

Speculators are parasites on a community. They buy up land so after a neighborhood works to increase its value they can sell it for a profit.

A Land Value Tax reduces their profit, which leads to fewer speculators, and therefore lower land prices. Buyers would therefore be people who want to live there and/or develop the property into something that would actually add value.

LVT therefore undeniably leads to more economic development, jobs, sustainability, and affordable housing.

LVT exists in Denmark, Hong Kong, Singapore, South Korea, Taiwan, and Pennsylvania, but if it’s so great then why hasn’t it been implemented in more places?

Two words: power and money.

Homeowners are a powerful voting bloc and speculators are a powerful lobbying group.

They have a self-interest in making land/housing EXTREMELY expensive. A lot of pensions and hedge funds also are built upon housing prices going up and up and up. How can they create an artificial bubble? For one, make lending easy (increases demand) so that anyone who wants a home can “buy” one! It’s normal in America for a 20-something to be hundreds of thousands of dollars in debt. Two, discourage housing construction (decreases supply) with high property taxes on improvements and strict zoning laws.

This may come as a shock to you, but the media and academia don’t have your best interest at heart. 2008 wasn’t a financial “crash.” It was a market readjustment. If the federal government didn’t step in to repatch the bubble then housing prices would be much lower today therefore benefiting the vast majority of the population. Housing is just about the only commodity where people actively celebrate rising prices, which is particularly heinous considering it’s an economic necessity. Imagine cheering on the rising cost of bread during a famine. Yet, this is what our influence-industrial complex does.

But I have hope for America because I believe speculators’ unprecedented success will bring about their unmitigated downfall…

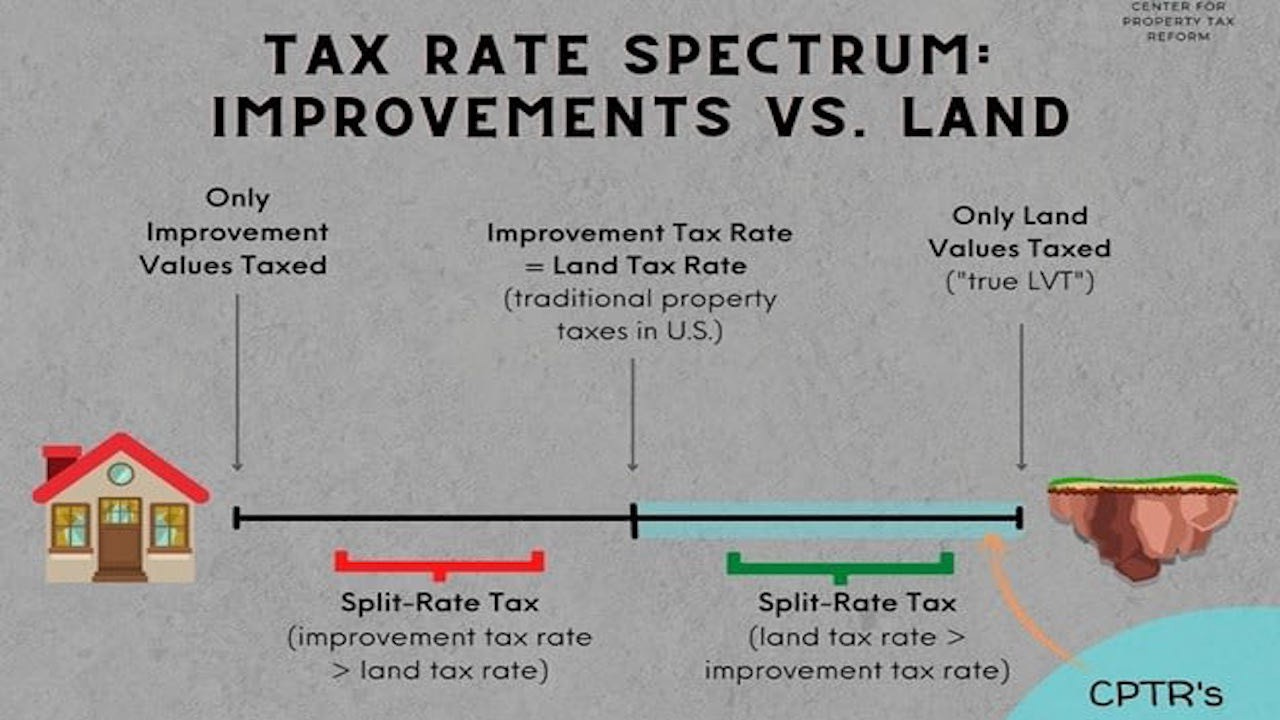

Ideally, it would just take explaining the benefits of LVT for more local, state, and national governments to implement it. A rational approach, so as to not penalize existing homeowners too much, would be to phase it in via split-rate taxation where the “land value” portion of a property tax would overtime be evaluated higher than the “improvement value.”

But this approach has thus far largely failed because as soon as homeowners hear “new tax” their prefrontal cortex shuts down and they start foaming from the mouth — “Brains! Land! Peace!”

Reforming property taxes is a political hire-wire act because even if a local politician is successful in implementing it, perhaps through a tax cut like a “universal property tax abatement” whereby the “improvement” portion of a property tax is cut more than the “land” portion is raised, then in the future as property taxes likely rise then rich speculators and unimproved lot owners will protest the loudest. Politics is often about plucking the goose without too much fuss.

For the record, I don’t blame homeowners for pursuing the American Dream. You can benefit from the system while advocating for its reform, but nonetheless, you have an ethical responsibility to advocate for its reform and whether or not the average homeowner actually benefits from perpetuating the status quo is debatable when you consider how it will end at Detroit.

Realistically, the reason I’m hopeful is not because I think a lot of homeowners will be persuaded, but because I think enough renters can be educated. In other words, I have hope because of demographic and technological changes.

Renters are rising!

As we make up more of the voting population then “generation rent” will have more political power to implement LVT.

And then as a final turn of the wheel, our feudalistic system is telling people, “My way or the highway!” and many of us are choosing the highway.

I believe one day there’ll be more mobile homeowners than traditional homeowners.

Did you know mobile homes don’t count toward property taxes?

Think about the long-term implications!

Mobile homes are becoming more energy-efficient (off-grid) and unlike traditional homes are built off-site via low-cost quality mass manufacturing. With more people working from home, families shrinking, and the population aging it only makes sense that the mobile home trend will continue to accelerate.

We may live in a future where every home is to some degree mobile because as manufacturing methods improve there’s nothing in physics that would prevent this convenience. Mobile skyscrapers!

LVT is just about the only tax that can’t be evaded.

If property taxes continue to be structured the way they are, i.e. heavily penalize “improvements/construction,” then it doesn’t make financial sense to renovate an old property, therefore paying even more in taxes annually, when you could just replace it with a mobile home whereby you’d end up paying nothing more than a de facto Land Value Tax!

With more and more of the population living in apartments and mobile homes, it’ll mean LVT is OTW.